I-526/I-526E data by TEA and country through early 2024

September 18, 2024 7 Comments

As I prepared Monday’s post on the Visa Bulletin, I looked at the number 9,158. This number represents 9,158 Chinese investors plus family who contributed at least $500,000 per family in 2014/2015 for the chance to qualify for an EB-5 visa. The Visa Bulletin showed “C” – no restriction – for China EB-5 through 2014 into the first half of 2015 (only beginning to establish cut-off dates in May 2015, and even then only implying a two-year wait with a 2013 date). How many of those people realized that they’d still be here a decade later, visa-less, a statistic on the 2024 NVC waiting list? Visa availability problems were predictable in retrospect, considering the 25,000 I-526 filed in 2014/2015, but we didn’t talk much about pipeline visa demand in those days. In honor of everyone taken sadly by surprise, and hoping not to repeat that history, we are more careful now to track and report not only the visa-stage demand reported in the visa bulletin, but also on pipeline demand coming up from I-526/I-526E filings.

I’m happy to report another important addition to the treasury of I-526/I-526E receipt data, with detail on visa category and petitioner county as needed for visa pipeline analysis. This dataset is courtesy of the efficient Joey Barnett of WR Immigration, who managed to extract a record-quick Freedom of Information Act response from USCIS, and immediately and generously made the full record available to the public. The data is published in a blog post here: “Exclusive New EB-5 Filing Data on Rural v. High Unemployment Area Demand as of April 2024!” You’re invited to join Joey Barnett and Charlie Oppenheim in discussing the data during the next edition of The Bulletin – Chatting with Charlie: EB-5 Investor Outlook on September 26, 2024.

Prior to the WR Immigration FOIA request, the most recent publicly-available TEA-and-country-specific data was from AIIA FOIA Series: Updated I-526E Inventory Statistics for 2023. The AIIA FOIA data was monthly through the end of 2023, and highlighted a handful of high-demand countries. The WR Immigration FOIA data is annual, but extends through the first part of 2024 and lists results for every single petitioner country.

The comprehensive county-specific detail in the WR Immigration FOIA provides interesting material for the question “where are regional centers finding EB-5 investors these days?” I see that AIIA already has a post up from this angle.

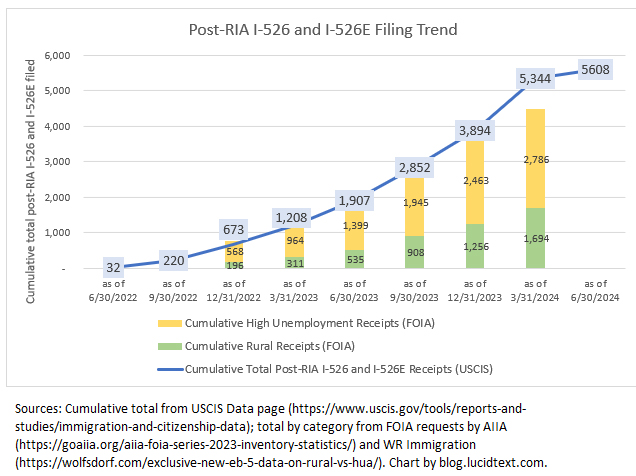

For backlog analysis, the WR Immigration FOIA is critical because it covers at least part of the great filing surge of Q2 2024, when 1,879 I-526 and I-526E were filed. We’ve needed to know where those 1,879 people came from, and where they invested, to help get a handle on potential TEA and country-specific backlogs. And now we have more information about it.

It’s tricky to date FOIA responses, because USCIS only reports the date that they queried the database, leaving us to guess how up-to-date the database was at that point. The WR Immigration FOIA is dated as of April 18, 2024. Comparing the FOIA totals with the totals that USCIS ended up officially reporting, we can conclude that the WR Immigration FOIA report captures cases filed through about February/mid-March 2024.

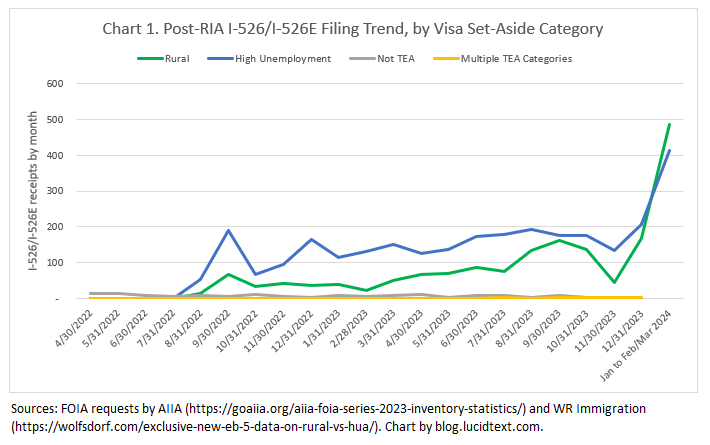

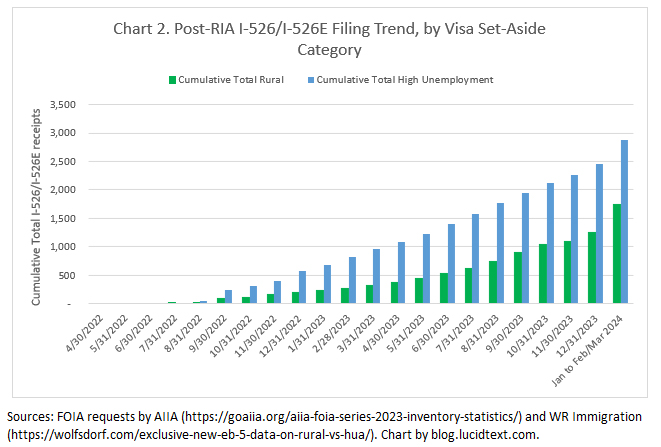

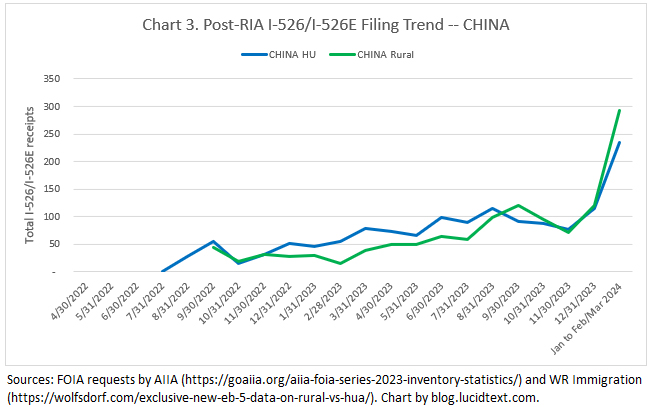

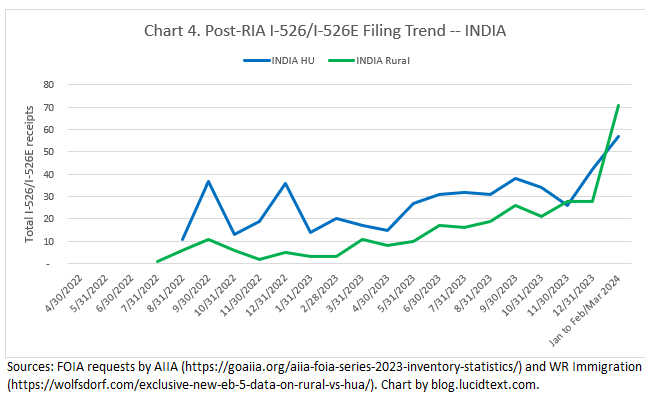

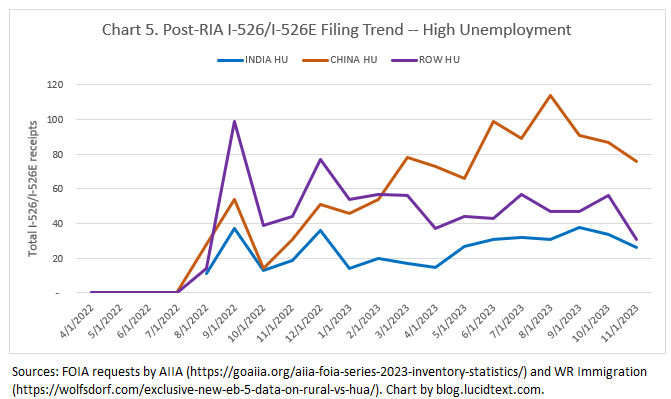

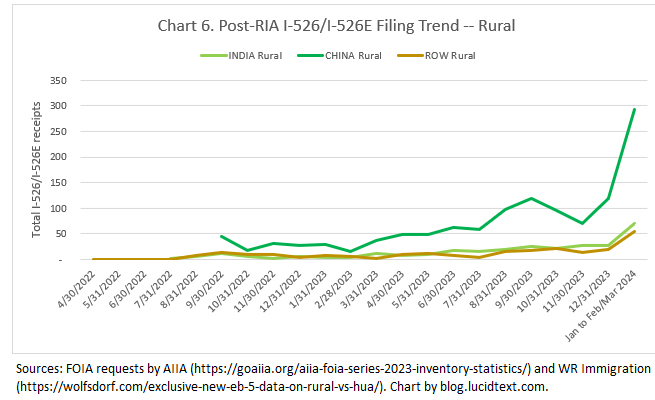

I’ll let charts tell the story of what happened during the recorded part of the March 2024 filing surge, including how Rural demand surged ahead for the first time (particularly thanks to China), while High Unemployment demand dipped but remained sufficiently strong to continue to dominate the cumulative inventory. (The charts combine AIIA’s FOIA data for 2022-2023 with WR Immigration’s FOIA for 2024.)

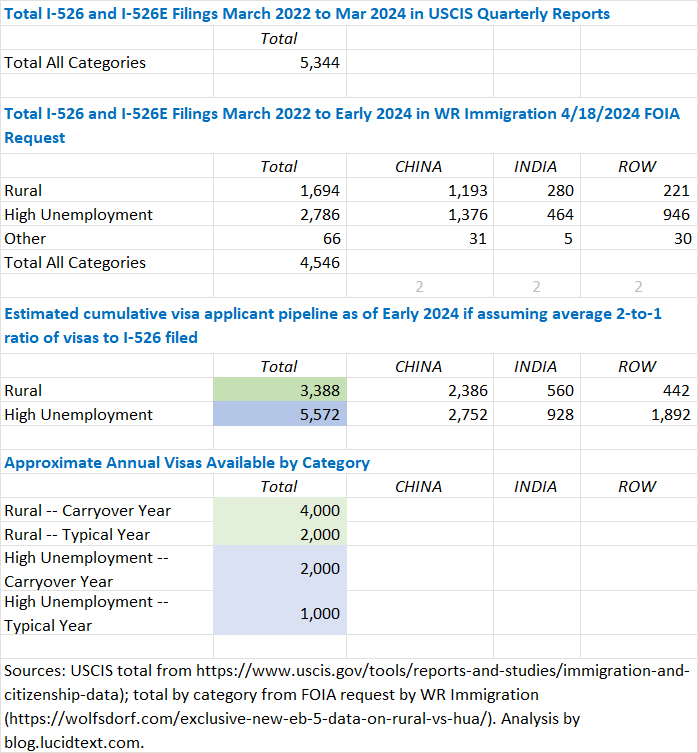

And finally, here’s the table that highlights my concern in the data: what’s going to happen to these data points when they’re people with families approaching the visa window?

For a rough estimate of future visa demand from the I-526 pipeline, I conservatively multiply the I-526 receipts by 2. This underestimates typical family sizes, but considers the possibility of denials and other attrition. And then I look at estimated cumulative visa demand and future visa supply and think about the balance.

FY2025 is carryover year, with extra visas available. What would happen in the best-processing case/worst-visa-case scenario that the entire pipeline of investors filing I-526 up to March 2024 reached the visa stage in FY2025? Looking at the numbers, I see that they would find enough rural but not enough high unemployment visas to accommodate them. In that case, FY2025 would end with Visa Bulletin cut-off dates for high unemployment, and a backlog going into FY2026 without the promise of carryover from unused HU visas. In real life, slow I-526E processing looks likely to continue to slow-walk the backlog (as it has been slow-walked to date) such that FY2025 doesn’t get sufficient applicants to max out FY2025 visas. In that case, the visa bulletin would not move yet in FY2025, and FY2026 would also have extra visas. In that case, the pipeline that had built by early 2024 would be getting visas in 2026 and years beyond.

If I were an investor from China or India, I would look not only at the China or India pipeline, but also at ROW (meaning applicants from the “rest of world”). ROW is important, because the number of annual visas available to me, as an applicant subject to country cap, is equal to 7% PLUS a share of any visas not absorbed by ROW. Every one ROW visa issued is one fewer visa that might be available to my country over the country cap. The ROW pipeline is also a target for people wondering if it’s possible to diffuse demand pressure from TEA set-aside categories. (But notice that High Unemployment shows enough demand from China and India alone to absorb 2+ years of visas even if they were the only applicants, even if 100% of the documented ROW HU pipeline left the HU category and chose to receive Unreserved visas instead.)

Still have questions about what the numbers mean? Note that the FAQ I just finished addresses topics such as which countries are affected by country cap limits and retrogression, how applicants may choose a TEA or Unreserved category, and how annual EB-5 visa availability gets calculated.

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

As always very helpful and thanks for taking the time to summarize it nicely.

My reading based on the numbers, the backlog for India and China in HU appears to be as severe as China’s unreserved category (8-10 years). Furthermore, the dual-code approvals (with only 14 approvals to date, including one each for China and India) are unlikely to provide significant relief and, at best, remain a mystery.

Do you agree with the assumption or I am crazy to think 8-10 year backlog in HU for China /india.?

I would not commit to a year prediction, but agree that the current pipeline High Unemployment inventory for India and China is alarming from a visa perspective. 5,500+ applicants is obviously a lot for visas that can only be issued about 2,000 in the first year and 1,000/year thereafter, even if visa issuance were simply FIFO with no country cap limits. Wait times would become unthinkable if China and/or India found themselves actually limited to only 7% of 1K (or initially 2K) annual HU visas. Such limitation is possible, if the documented Rest of World HU pipeline to date actually claims HU visas, and ROW demand continues robust. The margins are just so small working with 10% of EB-5 visas, as compared with Unreserved working with 100% (previously) and now around 68% of EB-5 visas. And the situation is volatile as well, since we can’t predict what will happen with denial rates or category-switching (which could reduce the backlogs), or legislative change (which could help or hurt).

If only Congress would make more visas available to match the willingness of foreign investors to support economic growth and job creation in distressed areas! Any possible visa relief needs to be at the top of all legislative agendas, because the regional center program won’t need to be renewed in 2027 if EB-5 is out of visas.

By the way, the hope of backlog relief I hear discussed is not from dual-code HU and Rural approvals, but from the fact that most/all High Unemployment approval notices apparently also include an Unreserved approval code that the applicant could select. I discuss this in Questions 5-10 here: https://www.canamenterprises.com/about-eb-5/faq/ (Another hope I’ve heard floated is from the realization that country caps technically apply across EB-5, not specifically in HU as a subcategory. But since China and India will predictably absorb 7%+ of Unreserved EB-5 for years to come based on availability and demand in Unreserved, there’s not much space for HU to compensate. I discuss this in Question 14 at the above link.)

Thanks for replying .

“High Unemployment approval notices apparently also include an Unreserved approval code”

I wonder why only for HU and not rural ?

Could it be because USCIS wants to avoid backlogging the rest of the world, as they’re not taking the overall 7% from EB-5? If this policy only applies to HU( especially for China & India)it effectively allocates 10% + 68% to HU and only 20% to rural areas, contradicting the promise of prioritizing rural areas.

I believe that the multiple codes on approval notices, including Unreserved, can apply to both HU and Rural. However, Department of State has said that (at least in the consular process) that it will not automatically assign a code in case of multiple codes — the applicant would have to choose which code to request. And before selecting Unreserved, post-RIA applicants would want to look at the thousands of pre-RIA applicants still queued up for Unreserved, including 10,000+ pre-RIA ROW Unreserved applicants. If choosing Unreserved, the post-RIA applicant would be behind pre-RIA applicants in the same country category based on priority date.

I was born in a uncapped country in ROW.

Let’s say I invest in a category, such as High Unemployment, and there is worldwide retrogression. Will USCIS process each applicant on a FIFO basis regardless of country? Or, will USCIS prioritize applicants from ROW and uncapped countries?

My understanding is that I need to invest in a project before or as I submit the I-526E. If I do this, wouldn’t I be selecting the category (Unreserved, Rural, HU, Infrastructure) at that time? If so, why would USCIS approve multiple categories for me and require me to select a category?

I assume that I should keep an eye on your posts and the Visa Bulletins so I can avoid the high demand categories. Am I correct to assume that the reserved categories (Rural, High Unemployment, Infrastructure) have higher risk (have a higher probability of not creating 10 jobs and have a higher probability of losing money than the Unreserved Category)?

What rough percentage of EB-5 investors invest in projects that fail to create the 10 jobs?

What rough percentage of EB-5 investors lose a significant amount of their money in the investments?

I hope that my recent post https://blog.lucidtext.com/2025/02/21/eb-5-visa-backlog-and-outlook-as-of-2025/ helps to address your questions about visa availability.

For the issue of assigning visa categories, and how a Set Aside investor might get an Unreserved visa, see Question 9. How and when does an EB-5 investor choose an EB-5 visa class? here https://www.canamenterprises.com/about-eb-5/faq/#faq-9-how-and-when-does-an-eb-5-investor-choose-an-eb-5-visa-class-

When there’s High Unemployment retrogression for all countries, then Department of State will issue visas FIFO to applicants from China, India, Mexico and Philippines each up to 7% of annual visas, and to FIFO to Rest of world up the to remaining annual visas available for the year. There are still distinct queues by country, it’s just that each queue has a stoplight Visa Bulletin date set for the last applicant possible to accommodate under current visa limits. That date can be different for each country queue, as already illustrated in the visa bulletin for non-EB-5 categories.

There isn’t official data for the number of EB-5 investors who end up without a permanent green card due to lack of job creation, or unable to recoup their investments. Google can lead you to stories of success and failure. Certainly, EB-5 involves both immigration and investment risk.

Thanks for your answers.

From Question 9 https://www.canamenterprises.com/about-eb-5/faq/#faq-9-how-and-when-does-an-eb-5-investor-choose-an-eb-5-visa-class- :

“When USCIS approves the investor’s I-526E petition, USCIS will issue a Notice of Action that confirms the specific visa category/categories for which the investor and his family can qualify.”

So, am I correct to assume that the way it works is like this?:

When I submit I-526E, I select multiple categories (Rural, HU), provided that I-956F was approved for multiple categories. I do this because USCIS might approve only one of the two. Or, USCIS might approve both Rural and HU, in which case I need to pick one. Is that correct?

From Table 2 at https://blog.lucidtext.com/2025/02/21/eb-5-visa-backlog-and-outlook-as-of-2025/ , am I reading it right that a ROW applicant in 2025 for Unreserved should get a visa after 2026, for Rural should get a visa as soon as processing times permit and for HU should get a visa after 2026? So, it sounds like it works like this:

Let’s say hypothetically there is a cap of 2 per country and there are 3 applicants from China and India each, and 3 from ROW. USCIS will issue:

1 to China, 1 to India, 1 to ROW

1 to China, 1 to India, 1 to ROW

0 to China, 0 to India, 1 to ROW

Is that correct?

Based on your Table 3, it seems that I, from ROW, should apply for (in order or preference): 1. Unreserved; 2. Rural; 3. High Unemployment. Correct?

Am I correct to assume that I should see the stoplight date in the Visa Bulletin for each country?