The trouble with the EB-5 sustainment timeline (comment on IIUSA lawsuit and proposed rule, EB-5 process table)

April 5, 2024 9 Comments

Last week IIUSA sued USCIS over Q&A that interpret the two-year minimum investment sustainment period, disputing that the EB5 Reform and Integrity Act of 2022 (“RIA”) actually changed the EB-5 sustainment requirement. Concurrently, IIUSA petitioned USCIS for rulemaking to write a minimum five-year investment holding period into the EB-5 regulations. This move is potentially extremely consequential for the program and for investors, and also problematic. My comment brings a perspective from EB-5 process timing.

The IIUSA litigation complaint explains why regional centers would seek government support for holding on to EB-5 funds for a minimum of five years:

97. As explained above, USCIS has long required investors to sustain their investment “over the two years of conditional residence.” 8 C.F.R. § 216.6(c)(1)(iii). This longstanding rule has incentivized regional centers to invest in high-quality projects that are more likely to generate return for investors, create the necessary number of jobs, and deliver benefits to the community at large. The practical reality is that these large-scale projects require longer investment periods, and as such the industry standard investment term for regional center-backed projects has typically been at least five years, and often longer.

The court might ask in response to this allegation: Why has the industry standard investment term “typically been at least five years, and often longer,” considering that the law and regulations have only ever name-checked “two years” when discussing the EB-5 sustainment period?

In practice, long holding periods have depended on USCIS capacity problems and visa oversubscription to insert delays in the EB-5 process around conditional permanent residence. The CPR period is the only EB-5 immigration process stage with a firm time attached (two years); all other stages in the process can be very short or extremely long depending on agency processing capacity and workflow and visa availability. The expected EB-5 investment period can vary wildly depending on processing delay plus whether/how the investment period is contingent on immigration milestones.

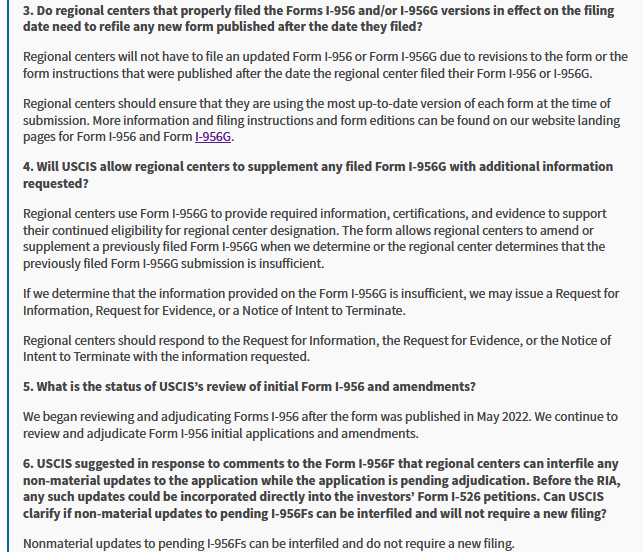

| EB-5 Process Stage | 1. Time from I-526 or I-526E petition filing to petition approval | 2. Wait time for visa number | 3. Time from I-526 or I-526E approval or visa availability to visa issuance | 4. Conditional Permanent Residence | 5. Time from I-829 filing to removal of conditions for permanent green card |

| How long is it supposed to take? | <120 days for TEA or <240 days for non-TEA (target I-526 processing time set by RIA) | No visa wait time so long as EB-5 usage keeps within visa supply limits | Varies depending on USCIS and DOS workload and staffing | Exactly 2 years by definition from admission under the EB-5 visa, with I-829 filed in the last 90 days of the period. | <90 days (target I-829 processing time set by 8 U.S.C. 1186b (c)(3)(A)(ii)) |

| How long can it take? | USCIS reports median I-526 process times since 2019 of 19 to 52 months (Total time is determined by USCIS workload and staffing. Adjudication touch time per I-526 is 20.69 hours per USCIS completion rates) | Visa wait time can be extremely long (10+ years), in the proportion that EB-5 applicants exceed annual visa supply. | Historically around 6 months if no delay; can extend to years in case of processing constraints. | Exactly 2 years by definition from admission under the EB-5 visa, with I-829 filed in the last 90 days of the period. | USCIS reports median I-829 process times since 2019 of 26 to 49 months (Total time is determined by USCIS workload staffing. Adjudication touch time per I-829 is 15.86 hours per USCIS completion rates) |

If the EB-5 process functioned as Congress intended, then the EB-5 investor could complete the immigration process within three years of the time of investment. People are so used to delay that they forget to do the math. Congress set a goal of 120-240 days for the I-526E processing (per the RIA Timely Processing targets, now in 8 U.S.C. 1153 note). After I-526E approval, the investor applies for the visa that initiates a two-year conditional residence period. (This period was set at two years by the Immigration Act of 1990 “to deter immigration-related entrepreneurship fraud”). The visa application is delayed by nothing but USCIS/DOS capacity to move paperwork, schedule interviews, and approve adjustments, unless excess visa number demand forces visa number waits. After 21 months of conditional permanent residence, the investor can file I-829 to remove conditions. I-829 processing is supposed to take about 90 days (2020 Final Fee Rule: “DHS acknowledges its obligation to adjudicate Form I-829 filings within 90 days of the filing date or interview, whichever is later. See INA section 216(c)(3)(A)(ii), 8 U.S.C. 1186b (c)(3)(A)(ii).”) or at any rate <240 days according to the RIA Timely Processing target. So much for government intent.

Investors take longer than three years to complete the EB-5 immigration process if and when (1) processing delays occur and/or (2) EB-5 gets oversold resulting in lengthy wait times for visa numbers. Both problems have been endemic for years, such that actual immigration times have predictably exceeded five or even ten years for many EB-5 investors as noted above. That doesn’t make the immigration delay situation normal or a right, however.

Part of the outrage over the IIUSA lawsuit comes from tacit admission that the plaintiff regional centers rely on the lengthy investment holding periods underwritten by immigration delays, and fighting to keep immigration support for such economically-advantageous holding periods. If established business models rely on an immigration process lasting much longer than two years, then they depend on USCIS processing problems and visa EB-5 oversubscription. That’s the sad fact, given process facts as outlined above. What gives? Will IIUSA sue USCIS for the progress it’s recently made toward realizing the RIA timely processing goals, because accomplishing timely processing could undermine projects that need to hold EB-5 money for much longer than the 3-year delay-free immigration process? Will IIUSA sue USCIS to conceal I-526E filing data, because such data helps avoid the visa oversubscription that can profitably inflate wait times? Will IIUSA advocate against visa relief, because lack of visa wait times would undercut profitably-long holding periods? Of course IIUSA would not consider such steps. But then why try to force lengthy holding periods specifically as an immigration necessity through litigation and rulemaking?

Immigration necessity has never been the only reason for an EB-5 investment decision. The holding period for an EB-5 investment is not simply the minimum period required by USCIS for immigration purposes – however that period may be calculated and defined — but also the time it takes a project to successfully create jobs and support an exit strategy. The promise of a five-year exit strategy is realistically more reliable than the promise of a two-year exit strategy for many types of projects, regardless of the EB-5 context. EB-5 investors have historically been willing to accept the prospect of a five year holding period as reasonable for the types of high-quality projects they want to invest in. Considering what’s practical on the investment side, projects with a two-year duration were likely not common even in the years before EB-5 processing delay. Of the 3,000+ EB-5 investments made since the EB-5 Reform and Integrity Act of 2022, I doubt many were in projects offering a two-year exit strategy, even though such projects have been technically allowable immigration-wise under USCIS interpretation of RIA. Investment holding periods around five years have indeed long been offered by regional centers and accepted by investors as reasonable to the type of investment, regardless of immigration policy.

But the general acceptability of a five-year metric does not make the IIUSA lawsuit right, or the rulemaking likely to succeed. If only a five-year holding period requirement had ever existed in law/policy, then IIUSA might sue USCIS to get it back. But it didn’t; “five years” was only ever an industry tradition. (Seeking an origin for the tradition, all I can find is Canadian government intent for the previously-popular five-year Canadian investor visa program that helped influence early industry expectations for EB-5. I blame Canada.) The only time reference for EB-5 in U.S. law or policy since 1990 was a conditional period defined as two years, though vulnerable to being deferred by processing delays and visa waits. All that IIUSA can sue to get back is a connection between that vulnerability and investor holding periods.

If the IIUSA lawsuit can convince a judge that USCIS invented its Q&A guidance, and that RIA didn’t actually decouple the required two-year EB-5 investment period from the two years of conditional permanent residence, the immediate result would be a return to holding periods indexed to however long it takes to get a visa number and start conditional permanent residence. Such a position could kill the future EB-5 market by reviving the nightmare prospect of redeployment. It could also betray the 3,000+ EB-5 investors who committed to the EB-5 program since the EB-5 Reform and Integrity Act of 2022, investing in reliance both on (1) the holding period specified in the offering, and (2) on the RIA law change, and USCIS confirmation of a minimum holding period not conditioned on immigration delay to conditional permanent residence. Why does industry wait to bring in nearly $3 billion dollars from post-RIA investors (incidentally creating the conditions for visa wait delay), then ask a court to pull the rug out from under the law/guidance that helped attract that investment, and that would protect from immigration delay?

In its statement for the public, IIUSA emphasizes that “Importantly, the purpose of this lawsuit is not to return to the previous sustainment policy that required many EB-5 investors to redeploy their capital for extended periods.” That’s good. However, the IIUSA lawsuit does argue for the previous policy of sustainment through CPR (see for example points 20, 100, 102, and 105 in the complaint). The IIUSA strategy depends on a two-step play to (1) convince a judge that RIA did not actually change the sustainment rules, but also separately (2) convince USCIS to itself change the sustainment rules via formal notice and comment rulemaking. IIUSA suggests to USCIS a fair-looking rule that would delete the CPR link (restoring the generally likeable change that RIA arguably made) while also introducing a 5-year minimum time (thus finally aligning USCIS policy with long-standing industry tradition).

Unfortunately the IIUSA strategy could only deliver on IIUSA intent to avoid previous sustainment policy if the lawsuit fails, or if the USCIS rulemaking process is short and reliable. If the lawsuit wins and rulemaking is slow and unreliable as usual, we’ll be stuck with the old policy IIUSA doesn’t want. For historical context, here’s the timeline of the last EB-5 regulation (EB-5 Modernization): USCIS announced that it was working on an EB-5 rule in 2014 and informally invited stakeholder comments, published the draft rule in the Federal Register as a Notice of Proposed Rulemaking in 2017, accepted public comments in 2017, published a Final Rule in 2019, and vacated the rule in 2021 following industry success in suing USCIS over the rule’s unfavorable content. The USCIS rulemaking process can be shorter than this, but I wonder if anyone can point to an example that took months not years. I also note that the public already provided extensive feedback to USCIS on the sustainment period following invitations to submit comments and questions for USCIS stakeholder meetings and the Ombudsman EB-5 meetings in 2023.

I suggest that plaintiff regional centers should have adopted a less perilous and tenuous strategy: education. If your projects practically need a five-year or longer holding period, then explain that to prospective EB-5 investors in economic terms, just as you’d explain to any investor. Show prospects how your offering is a better/more reliable/more profitable investment opportunity than the other guy who’s offering a shorter term, even if a shorter term is technically allowable under immigration rules. Remind investors that existing and long-standing USCIS guidance puts only a floor but no ceiling to EB-5 investment terms. The USCIS Q&A clearly says: “The INA establishes only minimum required investment timeframes for purposes of applicable eligibility requirements and does not place any upward limit on how long an investor’s capital may be retained before being returned. Regional centers or their associated new commercial enterprises can negotiate longer periods of investment directly with their investors independently of EB-5 eligibility requirements.” Point out that for investment and immigration purposes, the investment term naturally can be and must be as long as it needs to be to economically support required job creation and an exit. The economically-necessary term can plausibly be 5+ years for some if not most excellent projects, even as any promises of near-term exit strategies naturally merit extra scrutiny from investors.

What’s wrong is the attempt to claim or create an immigration necessity for lengthy investment holding periods, and try to force investor decisions in favor of long-term projects by saying that this isn’t just the economic case but what Congress and USCIS actually require for your visa. Such claims flounder for basis, reflect a shameful reliance on processing/visa delay, provoke investor outrage, and hurt the market. Program integrity will particularly suffer if the lawsuit is seen to betray the 3,000+ post-RIA investors who already committed to EB-5 before the lawsuit was filed to challenge USCIS interpretation of RIA, and now thrown into uncertainty and unforeseen exposure to visa-delay-induced redeployment risks beyond their initial agreed investment term. I am willing to believe that IIUSA leadership intended no such outcome, but what can be done to avoid it now that the lawsuit has been filed?