What the Report of the Visa Office 2023 shows about unreserved EB-5 backlog status for China, India, and ROW

March 9, 2024 7 Comments

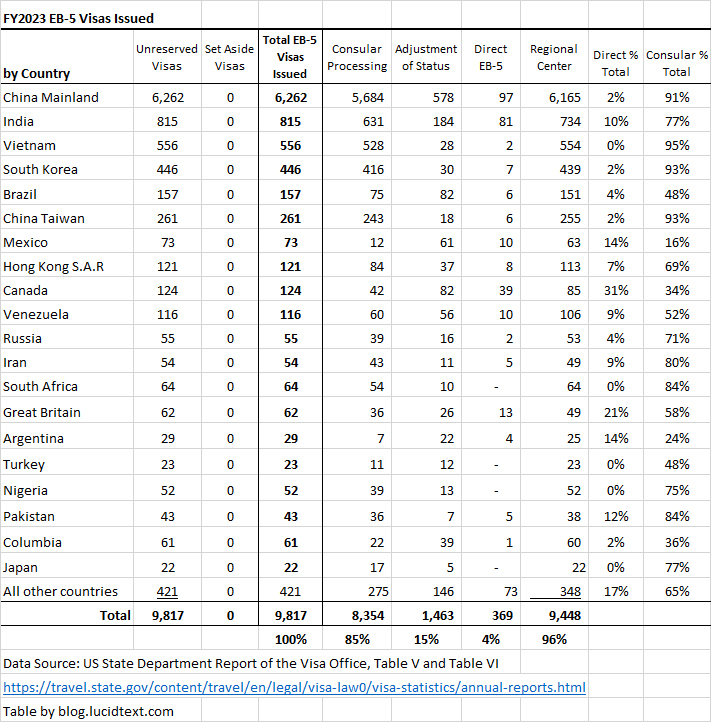

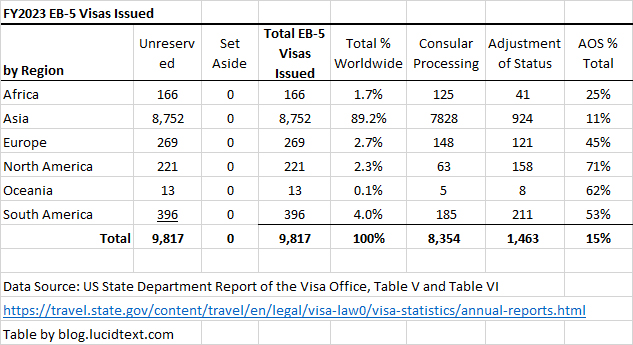

The Department of State has published its Report of the Visa Office 2023, including the final tally of EB-5 visas issued by country through consular processing and adjustment of status in FY2023.

The visa office report can be examined as an indicator of market interest in EB-5 visas, showing the countries of origin for EB-5 applicants in the last year, whether those applicants were already residing in the U.S. (thus adjusting status) or located abroad (getting visas through consulates), whether the applicants invested in regional center or direct projects, and whether the applicants chose Targeted Employment Area investments. At the very end of this post, you’ll find the tables I typically make to summarize visa office report data relevant to EB-5 market demand. Spoiler: EB-5 visas are still overwhelmingly going to applicants in Asia based on investment in regional center legacy TEA projects. (In FY2023, Department of State was not able to issue any set-aside TEA visas.)

But first, I’ve prepared tables based on my primary interest: what the visa office report tells us about visa backlog status for China, India, and Rest of the World countries. For my first chart, I take FY2023 EB-5 visa issuance numbers and put them in context of the 11/2022 NVC wait list (which shows how many EB-5 applicants were registered and waiting at the National Visa Center at the start of the fiscal year), and FY2023 visa availability (which shows how many EB-5 visas could/should have been issued under numerical limits during the fiscal year).

The good news for everyone: visa issuance in FY2023 met and even slightly exceeded the EB-5 annual limit (at least for unreserved) for the first time since 2017! No unreserved EB-5 visas wasted!

Good news for India and China. DOS did not limit India to 7% of unreserved visas in FY2023, but allowed nearly 7% of total EB-5 visas. China was allocated thousands more visas in FY2023 than one might have expected given the number of “rest of the world” applicants waiting for visas. On the other hand, Chinese and Indians should note the difference between applicants who were registered at NVC in late 2022, and consular visas issued in 2023. The difference equals the number of applicants who were already waiting in 2022 and apparently still waiting a year later: a difference that gives a reality check for interpreting the visa bulletin. Realizing that 731 Indians who registered at NVC in 2022 or earlier still didn’t have visas in late 2023, we know that the inventory of pre-2020 Indian priority dates can’t be clear, regardless of visa bulletin dates, unless denial rates were extremely high. I’ll be interested to see the NVC wait list as of 11/2023, which should be published shortly.

I’m most concerned looking at the visa issuance numbers for countries other than China and India, which are not limited by country caps and yet left many applicants behind. (As DOS clarified in 2023, country caps only limit the short list of countries that exceed 7% across all EB+FB categories. China and India are the only countries that are both high demand in EB-5 and also high demand across all visa categories. But countries without the individual 7% limit can still run up against constraints.) Of the more than 5,000 Rest of World EB-5 applicants registered at the National Visa Center in late 2022, over 3,000 didn’t get visas in FY2023. Those applicants weren’t constrained by anything in FY2023 except consular capacity to schedule interviews; technically 3,000 visas could have gone to them in FY2023 instead of being considered “otherwise unused” and assigned to China over China’s country cap. (Unless denials account for a significant part of the gap, but the consular EB-5 denial rate is historically not very high — averaging 9% in 2016-2021.) DOS apparently left many ROW applicants to wait in a small backlog, which I foresee is about to become a large backlog as USCIS is finally aggressively approving I-526 and advancing thousands more ROW applicants to the visa stage. (Another post on this coming soon – the latest I-526 and I-829 processing numbers are excellent.) Backlogs can be a wait time issue even for countries not subject to country caps, as you know by looking at any visa bulletin and seeing the final action dates for ROW in EB-2, EB-3, and EB-4. The backlog tipping point in EB-5 for “rest of the world” countries will come when ROW applicants for unreserved visas collectively exceed 86% of unreserved visas available – i.e. when ROW unreserved reaches about 6,000 applicants. (Logic: Chinese and Indian unreserved applicants have older priority dates than most ROW applicants, so Chinese and Indians will get allocated EB-5 visas first up to the 7% cap for each country, collectively claiming 14% of visas. So more recent ROW applicants collectively can’t be allocated more than 86% of visas in a year, and any ROW applicants exceeding that threshold will be cut off by the visa bulletin and have to wait for visa availability in a future year.)

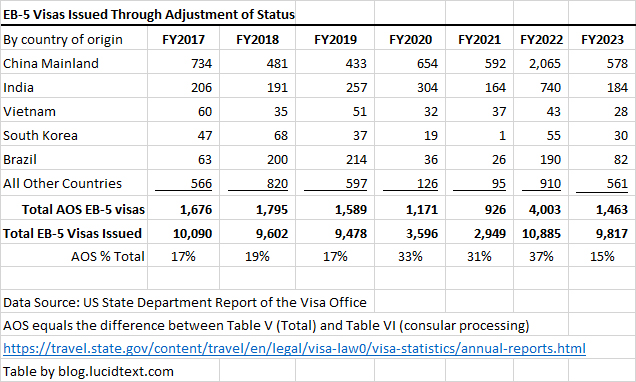

I went on to make a table showing the multi-year trend in visa availability, demand, and issuance for China, India, and ROW. The table highlights the tragedy of 2020-2022, when COVID-19 followed by the nearly year-long regional center program shutdown resulted in the loss of 25,880 EB-5 visas. The table illustrates that processing capacity for ROW visa issuance has been a long-term problem, with consulates regularly issuing thousands fewer visas than available to and demanded by ROW. On the other hand, this problem for ROW has been a boon to applicants from China, whose numbers depend on the number of visas leftover from ROW (except in 2020-2022, when China’s numbers sadly depended on a closed consulate and closed regional center program).

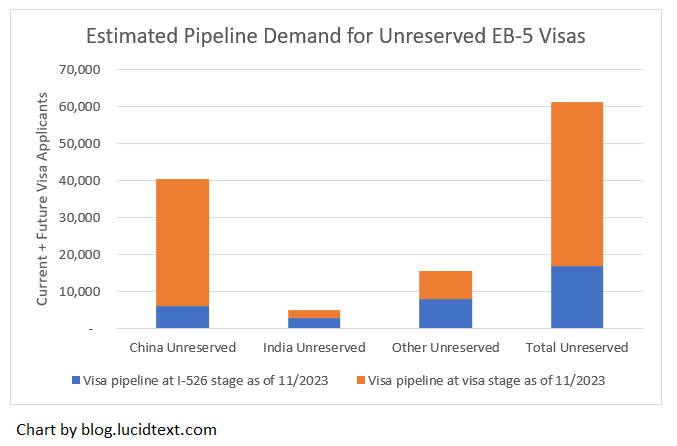

In thinking about supply and demand for unreserved visas, we want to not only look at what’s been happening at the visa stage, but also visualize what’s coming down the pipeline as more I-526 get approved. The following table shows the steps I take to estimate the total pipeline demand for unreserved visas as of the end of 2023. Note that this table only estimates demand from pre-RIA investors. Any post-RIA investors who go for unreserved visas will be placed – based on priority date order – at the end of the pre-RIA queues. In other words, my estimate of the existing unreserved visa pipeline suggests that a post-RIA applicant for an unreserved visa would find himself #40,000+ in the China unreserved queue, #5,000+ in the India unreserved queue, or #15,000+ in the Rest of World unreserved queue. Not the place to be, with only 6,800+ total unreserved visas available annually! We’re concerned to see the set-aside queues filling up, because there’s obviously no room for spill-over into the unreserved category.

| Calculation Steps | Pre-RIA Unreserved Visa Demand Estimate | China Unreserved | India Unreserved | ROW Unreserved | Total Unreserved | Note |

| A | I-485 pending as of 10/1/2022 | 736 | 234 | 893 | 1,864 | Total is actual; per-country is a guess considering visa issuance |

| B | NVC wait list as of 11/2022 | 38,874 | 1,362 | 5,262 | 45,498 | Actual |

| China | India | ROW | ||||

| C | Consular visas Issued FY23 | 5,684 | 815 | 1,855 | 8,354 | Actual |

| D | AOS visas issued FY23 | 578 | 184 | 701 | 1,463 | Actual |

| E=C+D | Total Visas Issued 2023 | 6,262 | 815 | 2,740 | 9,817 | Actual |

| China | India | ROW | ||||

| F=B-C | People waiting at NVC in 11/22 still waiting in 11/23 | 33,190 | 547 | 3,407 | 37,144 | Actual |

| G=A-D | I-485 pending as of 11/22 still pending as of 11/23 | 158 | 50 | 192 | 401 | Total is actual; per-country is estimate |

| China | India | ROW | ||||

| H | Estimated new visa applicants in 2023 from I-526 approvals in 2023 | 1,000 | 1,500 | 4,100 | 6,600 | Estimate from I-526 approvals in 2023 (world is actual, per-country is guess based on known per-country inventory as of 3/2022 and PD of I-526 approvals in 23), assumes 2.5 visas per approval |

| I | Estimated future visa applicants from pre-RIA I-526 currently still pending as of 11/2023 | 6,000 | 3,000 | 8,000 | 17,000 | Estimate from pending inventory (world is known, per-country is guess based on known per-country); estimate 2 visa demand per pending I-526 |

| China | India | ROW | ||||

| J=F+G+H+I | CONCLUSION: Estimated total pre-RIA unreserved visa pipeline as of 11/2023 | 40,348 | 5,097 | 15,699 | 61,145 | |

| I | Visa pipeline at I-526 stage as of 11/2023 | 6,000 | 3,000 | 8,000 | 17,000 | |

| F+G+H | Visa pipeline at visa stage as of 11/2023 | 34,348 | 2,097 | 7,699 | 44,145 |

And finally, tables summarizing market-relevant data from the Report of the Visa Office 2023.

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

Suzanne, as always excellent report. One question, how did any Chinese do Adjustment of Status?

Adjustments of status reflect people from all over the world, including China, who are currently in the U.S. on another visa status (e.g. non-immigrant workers and students).

Hi Suzzane,

Thanks for keeping us updated throughout our EB5 journey. I was confused with Fy2024 availability for unreserved category. Shouldn’t 13.5K unused reseved visa flow to unreserved category this year(2 year rollover rule). 11.4K availabilty doesn’t seem to be taking that into account.

Naveen, thank you for flagging this. It was my mistake to omit FY24 carryovers, and I’ve now fixed the chart in the post.

Hi Suzanne,

Would it be right to interpret that ~80% (~520 start of the year and ~400 approved YoE) of Koreans will receive their EB-5 visa within a year after they are in NVC (After I-526 & DS-260 qualified)?

Hello Suzanne,

Amazing analysis and article. Pre-RIA unreserved India backlog seems to be about ~5000 visas in total(that too with a conservative approach). Given going forward (FY2026 and beyond), there will be only 6800 unreserved visas each year or about(476, 7%) for India available, we may need ~10 years to clear the entire pre-ria India backlog, if everything else doesn’t change.

However, Priority dates seems to suggest EB5 India FA dates may hit April 22 by end of this fiscal year. Any idea how to interpret these two ? Is USCIS assuming it will use up majority of spill over visas from reserved category in FY2024 and FY2025 and hence these very forward looking PDs for India ? (Even if this is the case, not sure if it is enough to make a serious dent in the pre-ria India backlog).

Thank you.

This article explains how I understand 2024 visa bulletin movement for India: https://blog.lucidtext.com/2023/12/20/running-ahead-in-the-january-2024-visa-bulletin/