2+ years from when? EB-5 sustainment period in context

April 29, 2024 4 Comments

This week I’m excited to participate in a webinar designed to shine light from multiple directions on the hot button issue of the required EB-5 investment timeframe. The webinar features top EB-5 lawyer Robert Divine, who first noticed and wrote about how the EB-5 Reform and Integrity Act changed the EB-5 sustainment period (interpretations reinforced by the USCIS Q&A but then challenged by the IIUSA lawsuit). The webinar is hosted by venerable regional center operator CanAm, which has a long-standing leadership role in the industry and IIUSA, and has shepherded thousands of investors through the EB-5 process. I’ll be there, as someone who gets heated-up about sustainment as a business plan writer, advocate for EB-5 timing issues, and member of both IIUSA and the investor organization AIIA. Will we have a big fight? Tune in on Thursday May 2 at 1 E.T. to find out! (R.S.V.P. for the webinar here.)

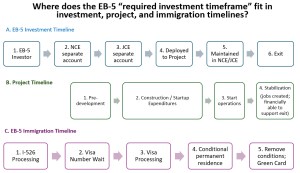

I think the audience will benefit from a panel coming together with different perspectives, but on the common ground of mutual respect, long experience navigating industry complications, and a common objective of clarity (not an advertising agenda disguised as analysis). The webinar is titled “Putting the 2 Year Sustainment Requirement into Context: What questions should investors be asking?” The idea isn’t to get theoretical about the IIUSA lawsuit or to argue about what policy should be, but to look closely and practically at the policy in place today. We’ll discuss the USCIS Q&A on required investment timeframe, what it says, and how to understand it in context of immigration requirements and investment/project practice. “For how long can/must/will the issuer hold EB-5 money?” What a basic and critical question, and yet with so much confusion, controversy, and self-interested messaging around it. We hope that Thursday’s webinar can help add some clarity and nuance, and empower investors to ask good questions about EB-5 offerings.

I hear people talking about “two years” or “five years” or “seven years” in isolation, as if EB-5 were a direct payment program where immigrants get a green card in exchange for letting someone hold money for a fixed period of time. But EB-5 is not that kind of program; instead, it awards green cards based on at-risk investment that creates jobs. The EB-5 investment holding period requirement exists in context of those defining features of at-risk investment and job creation, not in isolation. This insight has major practical results. For example, working within the ”at risk” requirement means that “Day 1” of the required 2-year minimum investment period is not the date of EB-5 investment in the NCE, and the EB-5 investor’s exit date cannot be guaranteed upfront at given number of years. We’ll talk about the factors that do define the sustainment start and end dates, according to current USCIS policy and practical reality, and how to assess those dates in a particular offering.

what is the relevance of Sustainment period in relation to PRE RIA INVESTORS.

This week’s webinar will focus on the sustainment period policy specifically for post-RIA investors, and may not be of interest for pre-RIA (who are currently subject to a different policy that deserves its own webinar). For both pre-RIA and post-RIA, the sustainment period is extremely consequential (since it defines the earliest exit date for immigration purposes), and is determined and complicated in part by how to interpret the EB-5 “at risk” requirement. AIIA has written about the pre-RIA sustainment period: https://goaiia.org/the-nightmare-that-is-eb5-redeployment/

Meanwhile you have millions of people just jumped through the Mexico border. What’s the point of all of these effort?

EB5 rather a tedious process where investors are legally exploited but those who succeeds get legal immigrant status.