FY2024 Q4 EB-5 Form Data

December 20, 2024 2 Comments

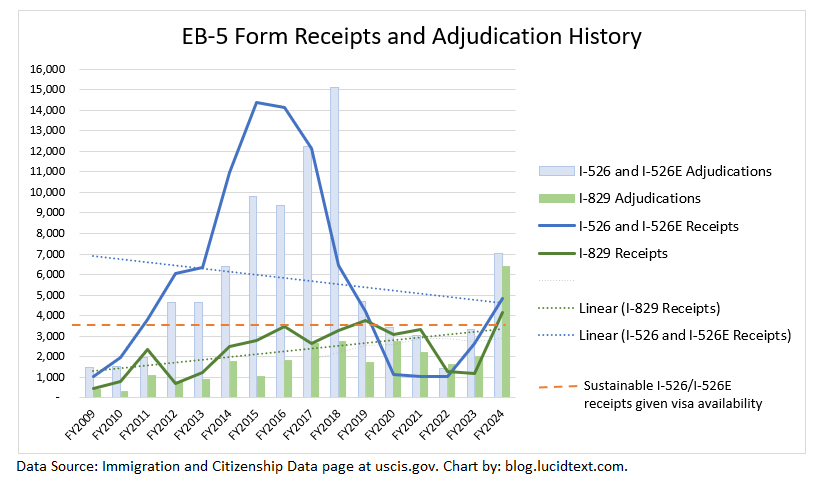

USCIS has finally updated the Citizenship and Immigration Data page with form receipt and adjudication numbers through September 2024, the end of the fiscal year. The numbers continue to show encouraging EB-5 processing improvements and robust but sadly unsustainable EB-5 demand.

I put the FY2024 data in context of the fifteen years since I launched my business plan writing service and started blogging about EB-5.

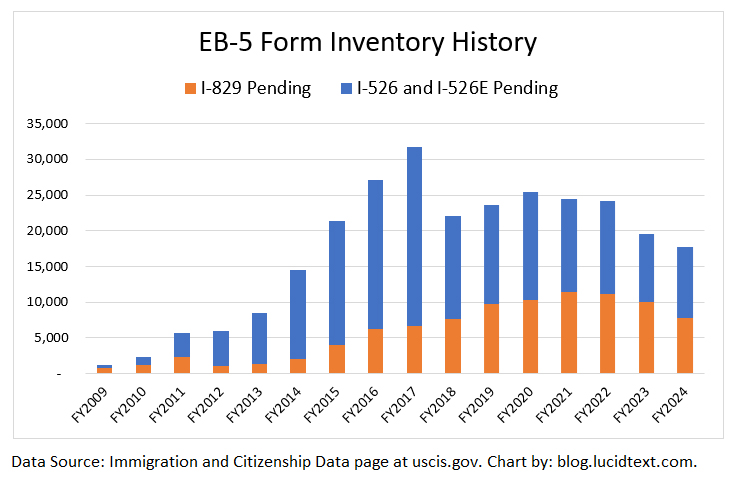

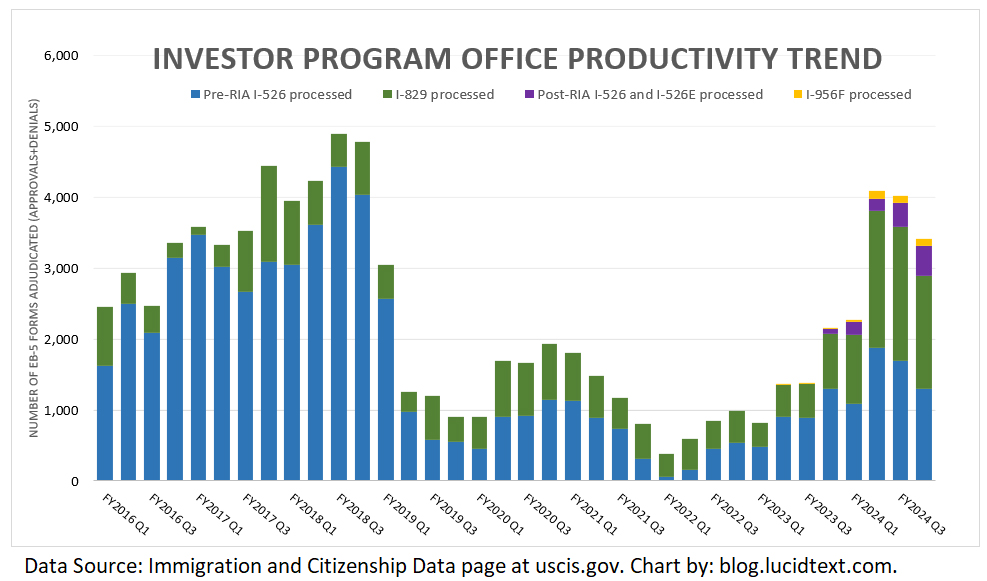

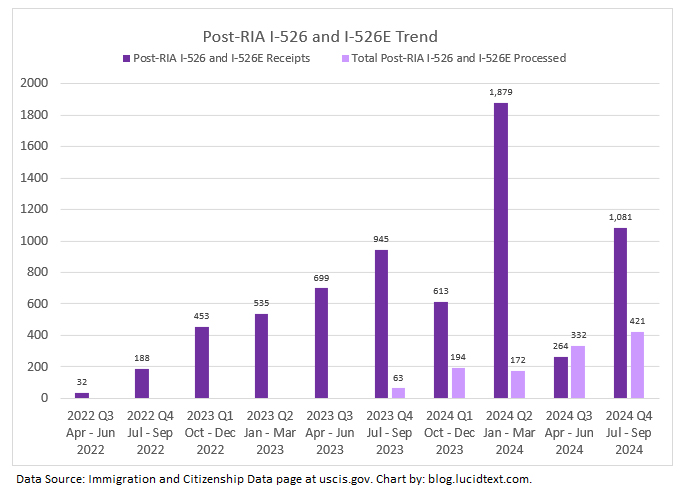

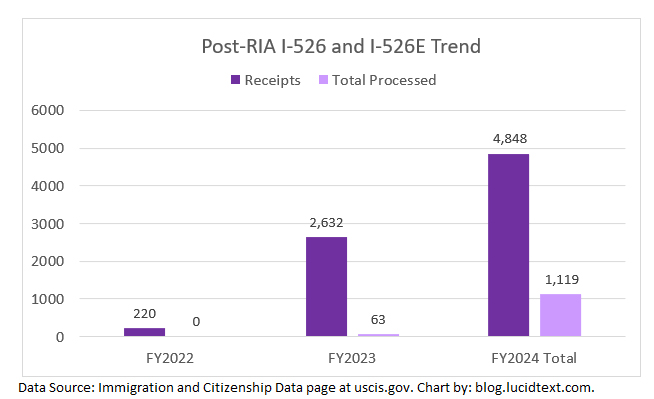

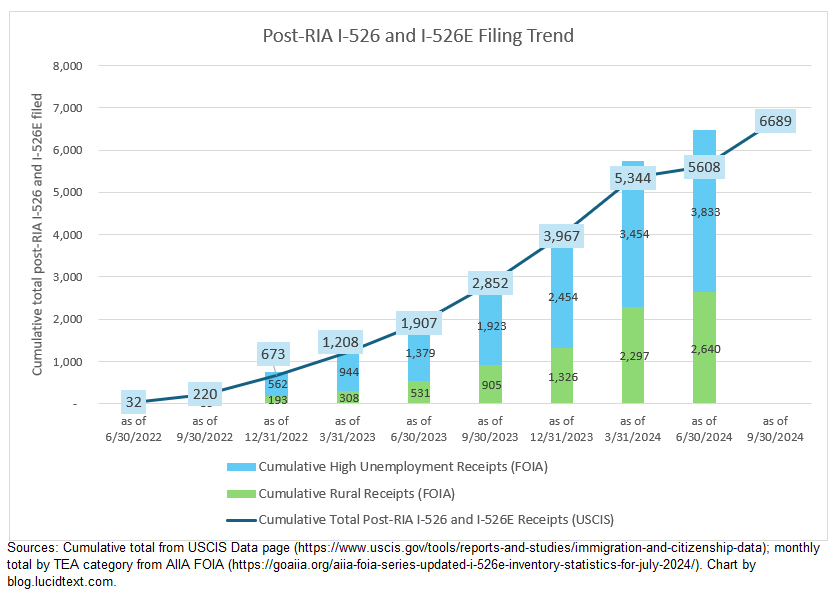

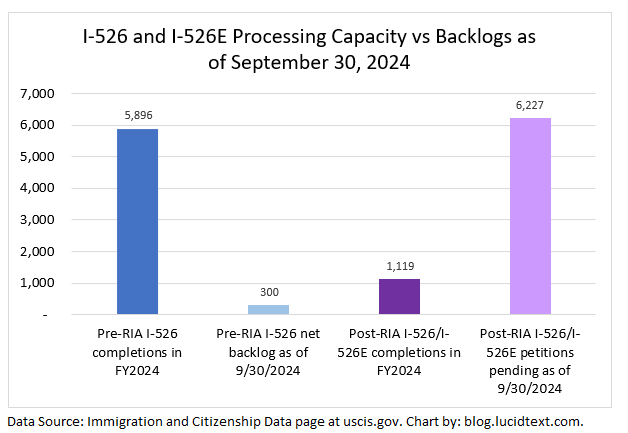

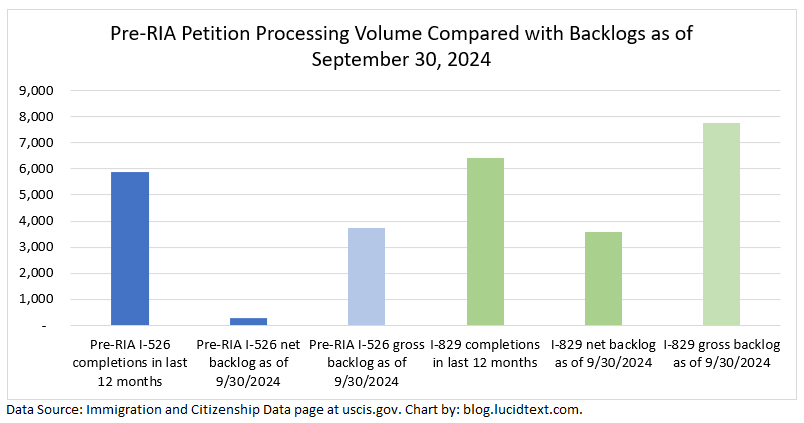

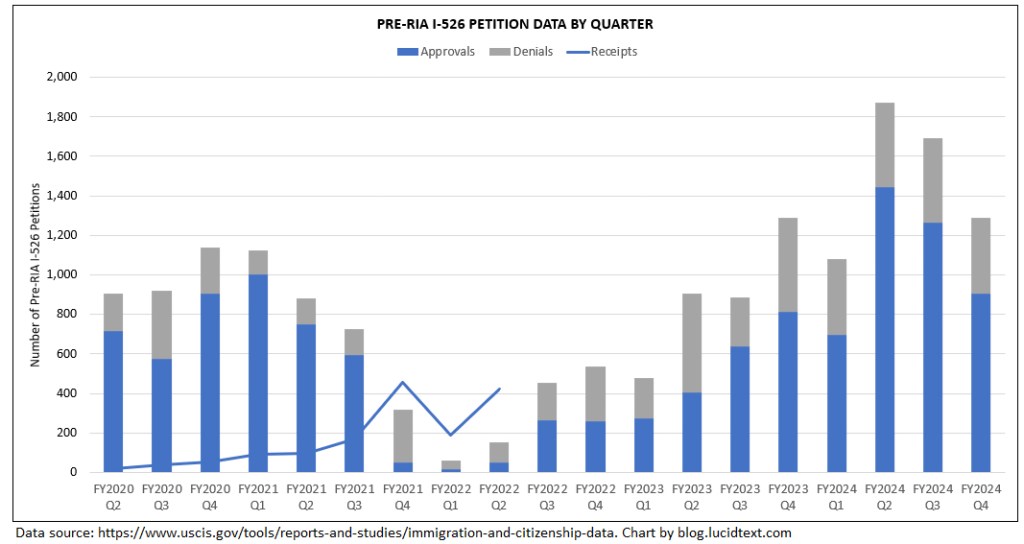

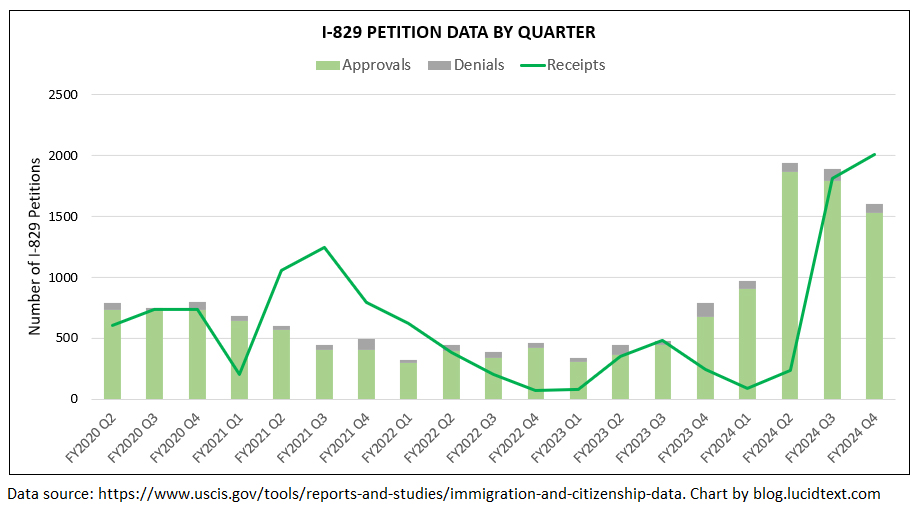

The chart shows that USCIS just had its best EB-5 processing year since 2018. EB-5 form completions more than doubled from the previous year, and reduced the I-526 and I-829 backlog to the lowest level since before 2015. USCIS also managed to process 1,119 post-RIA I-526 and I-526E, thus generating a significant number of applicants for set-aside visas in 2025. If the processing capacity applied to pre-RIA I-526 in 2024 is moved to I-526E in 2025 (as it might be, considering that the net backlog for I-526 is only 300 forms), then nearly all currently-pending I-526E could be processed in 2025. This is the good news.

Meanwhile, I-526E receipts in FY2024 reflect EB-5 demand at its highest level since before 2019, and once again shooting above the level possible to accommodate under the EB-5 numerical limit (i.e. about 10,000 visas annually, of which historically an average 38% go to investors while the rest to go spouses and children). Incoming EB-5 demand is largely aimed at the fraction of visas in set-aside categories, and lacks an escape route since Department of State is still working through the legacy Unreserved visa backlog generated by excess EB-5 demand from 2012 to 2019, as illustrated in the above chart. When the Unreserved backlog disappears (which I calculate could happen by 2030), thus clearing the way for post-RIA applicants to access Unreserved as well as Set-Aside visas, the 10,000 annual visa limit would still not be sufficient to accommodate new investors coming in at a rate of nearly 5,000 per year, as happened in FY2024.

The above chart illustrates that EB-5 needs, overall, about 30% more annual visas than it has, in order to close the gap between actual/potential and sustainable demand. (If we drilled down to historical imbalances by country and TEA category, the gap would be greater than 30% in some cases and less in others.) If the visa demand gap isn’t closed by increased visa supply, it will be closed by plummeting EB-5 usage when prospective investors see the gap producing backlog delays.

I am committed to doing whatever I can to support relief from the current unsustainable situation in EB-5, whether that be any possible EB-5 visa relief, or measures to make visa wait times more tolerable. I have been in advocacy conversations about legislative options, and have tried to support data and education to make visa wait times at least more understandable and predictable. I oppose measures such as the IIUSA sustainment lawsuit that would make visa wait times more painful and unattractive by linking repayment timing to visa timing for post-RIA investors. I also made the tough decision this year to stop writing regional center EB-5 business plans, given my backlog analysis, though that work had been my bread and butter for over a decade. Not that my small professional sacrifice will make a difference, but it reflects how seriously I take the current EB-5 backlog problem. I don’t want to help dig the hole deeper, and I hope for the day when EB-5 can become sustainable — which it may, if many people take the current problem seriously. Immigration opportunity in exchange for economic development and job creation is a beautiful thing, when it’s real. EB-5 investment has supported so many good projects and business ideas, and it needs to be able to realize its immigration promise to investors, including investors from China and India.

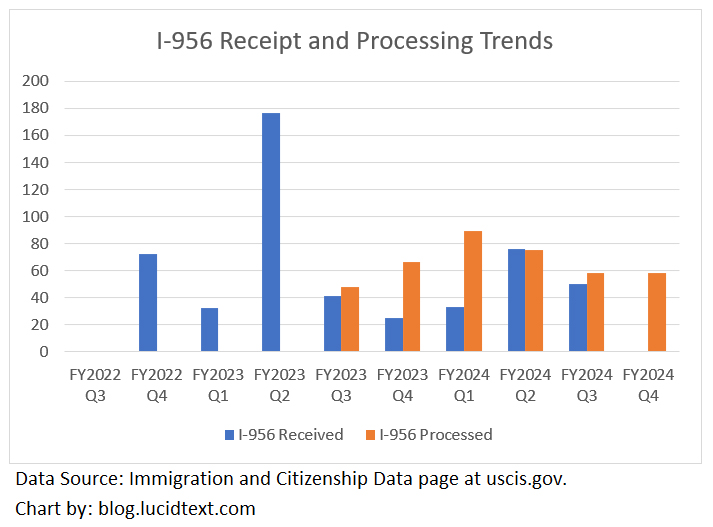

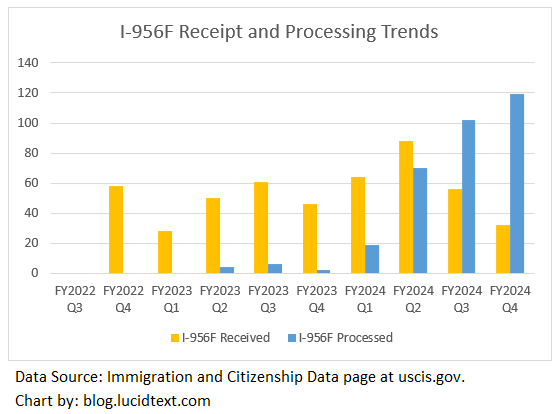

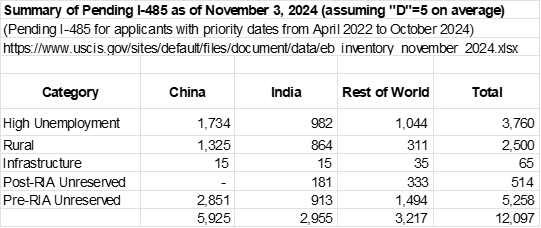

And now for a full set of charts for the FY2024 Q4 data. I notice that I-956 and I-956F receipts have been falling while adjudication volumes continue to grow – an interesting industry phenomenon and a good sign for processing times. I-829 receipts reached an unprecedented high this year. Are people increasingly removing conditions individually rather than as families with the principal applicant? Denial rates remain very low for post-RIA forms and I-829, and elevated for legacy I-526. I included a summary table for the pending I-485 inventory as of November 2, 2024, showing over 12,000 EB-5 adjustment forms pending. And I note that Department of State has also published the first month visa issuance report for FY2025. Only 6 post-RIA visas were issued through consular processing in October 2024 (3 high unemployment, 2 rural, and 1 unreserved), but the Visa Bulletin suggests that Department of State expects this pace to increase shortly. I’ve also updated my Processing Data page with the Q4 data.

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

I wonder if you observed any change in the rate of processing since the new administration came in?

We don’t yet have solid information about EB-5 processing under the new administration, only individual anecdotes and analysis based on small samples. It will probably be summer before we can reasonably draw conclusions about what’s happening right now with form processing. Until then, we’re left with guesses and limited data that can be misleading. I guess that processing volumes are still high overall at the moment, but will fall.