EB-5 processing volumes fall in USCIS FY2025 Q1 data report

April 30, 2025 5 Comments

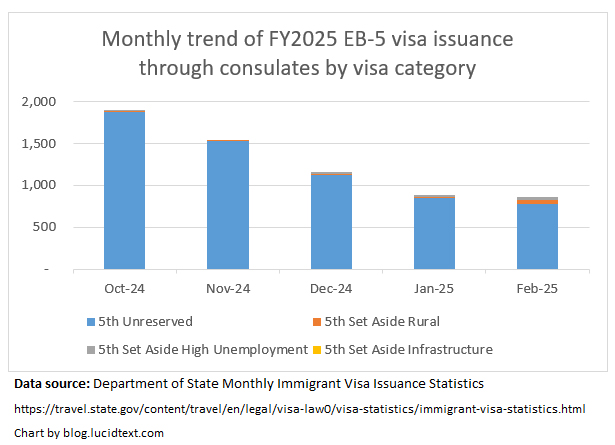

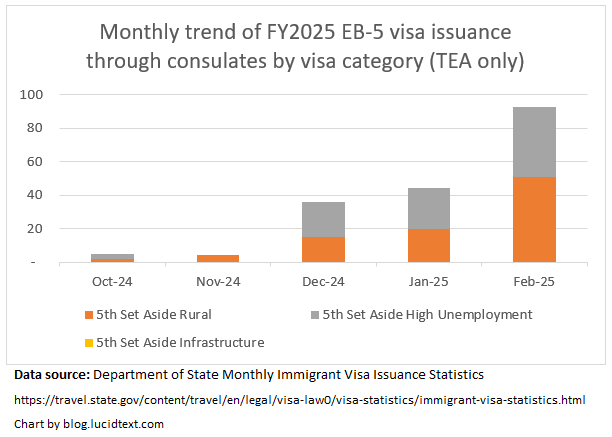

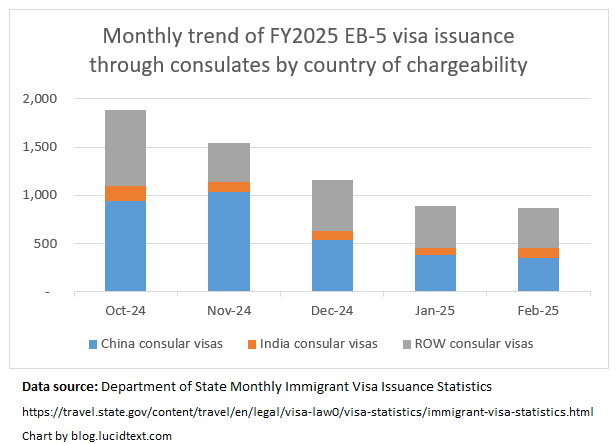

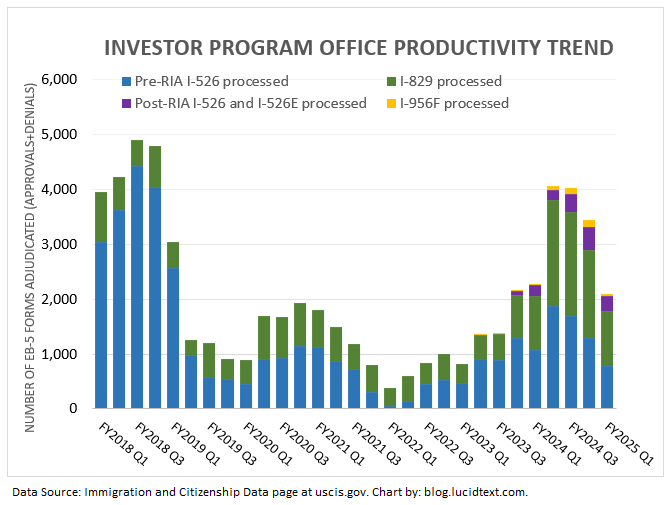

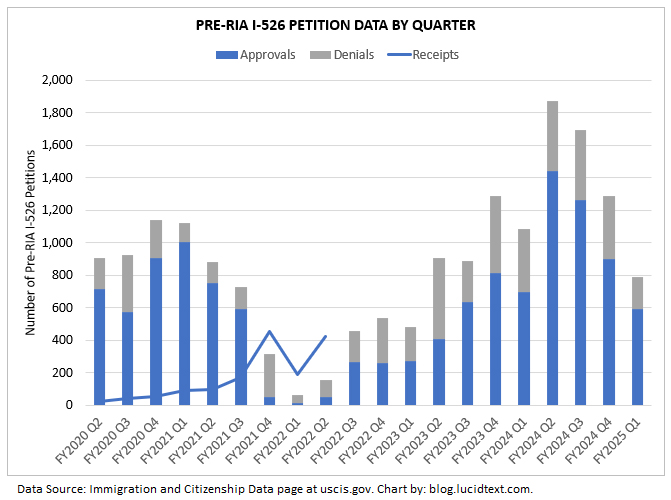

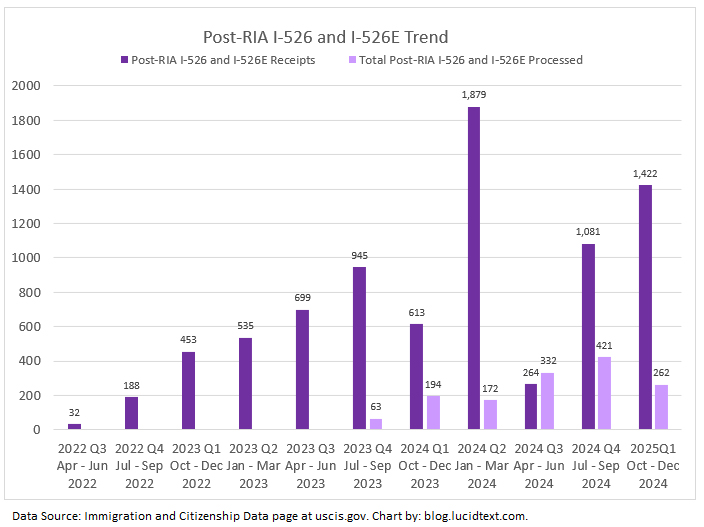

And now, the USCIS Immigration and Citizenship Data page has finally published performance data for the first quarter of FY2025 (October to December 2024). The data shows a strong start to implementing the new administration’s immigration agenda. Last time around, it took two years for USCIS staffing and policy changes to translate into sluggish EB-5 form processing. This time, IPO preemptively cut its processing productivity in half even before the inauguration. Maybe October to December was an aberration, with no political connection and no trend to worry about. But at least for the one quarter, every EB-5 form suffered. I had expected USCIS to start shifting more resources to I-526E, given the visa urgency and dwindling I-526 workload, but this did not happen through the end of last year. Meanwhile, as previewed in AIIA’s data by country and TEA category, I-526E filings continued to shoot up through the end of 2024.

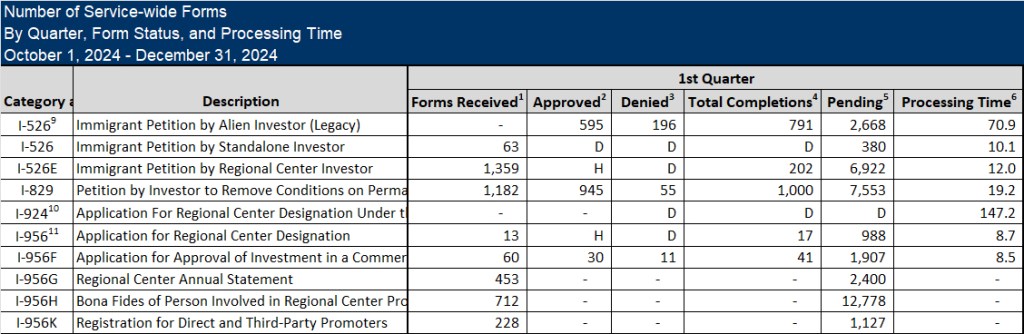

The FY2025 Q1 report is notable for including, for the first time, median processing times for post-RIA I-526 and I-526E.

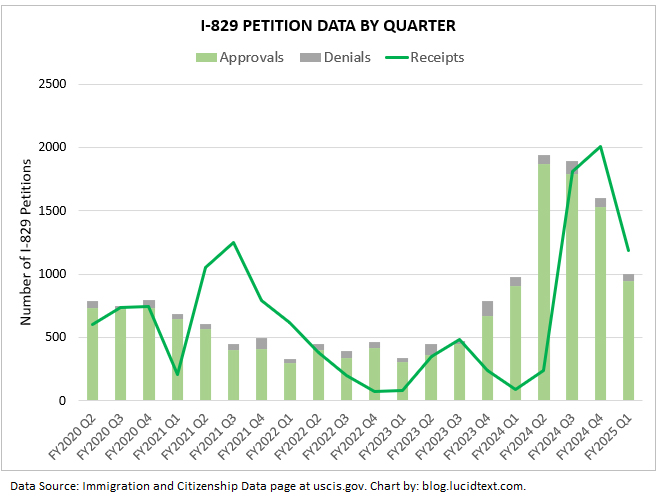

Be cautious in interpreting the Processing Time number, which is not necessarily predictive! Footnote 6 to the Processing Times column explains: “Processing times are defined as the number of months it took for an application, petition, or request to be processed from receipt to completion in a given time period. The number of months presented is the median which is the time it took to complete 50% of all the cases processed in the quarter.” I’m very happy for the 50% of recently-completed I-526E that experienced a processing time of less than 12 months. However, 50% of the 202 completions in FY25 Q1 is just 101 forms — barely 1% of the inventory. How long will it take to process the 6,922 I-526E that remained pending at the end of last quarter? If USCIS kept going at the FY25 Q1 processing pace, then it would take 6,922/202=34 quarters=8.6 years. In order to get through the pre-2025 I-526E inventory in 12 months from now, USCIS would have to increase quarterly I-526E processing volume to 6,922/4=1,730 completions. On the other hand, the reported median processing time of 19.2 months for I-829 may be reasonably predictive, so long as USCIS can keep processing the I-829 inventory (7,553 at last count) at a rate of at least 1,000 completions per quarter.