EB-5 Visa Backlog and Outlook as of 2025 — UPDATED

May 21, 2025 9 Comments

I have completely updated the EB-5 Backlog Analysis linked to my EB-5 Timing Page. The new version is more streamlined, adds scenarios, and reflects the latest available data, including 2025 AIIA FOIA data for actual I-526/I-526E receipts by country and TEA category through January 2025. This article replaces my previous post on EB-5 Visa Backlog and Outlook as of 2025, which had assessed visa backlogs based on data published through mid 2024.

My previous analysis foresaw 2025 Rural and High Unemployment investors from China and India potentially getting visas from 2029 to the early 2030s — considering the backlog visibility in mid 2024, and hopes for high visa issuance in 2025.

What has changed? We now know that the pipeline backlog for Reserved visas has been rapidly expanded by new investors, while advancing more slowly than expected through USCIS processing. This adds up to more severe wait time outlook for China and India, which now have more people queued up for fewer visas available. My updated analysis highlights backlogs within each popular EB-5 lane (Unreserved, Rural, High Unemployment), and considers how switching between lanes could optimize visa availability. I also updated the model with a tool to model potential visa number wait times for a variety of priority dates.

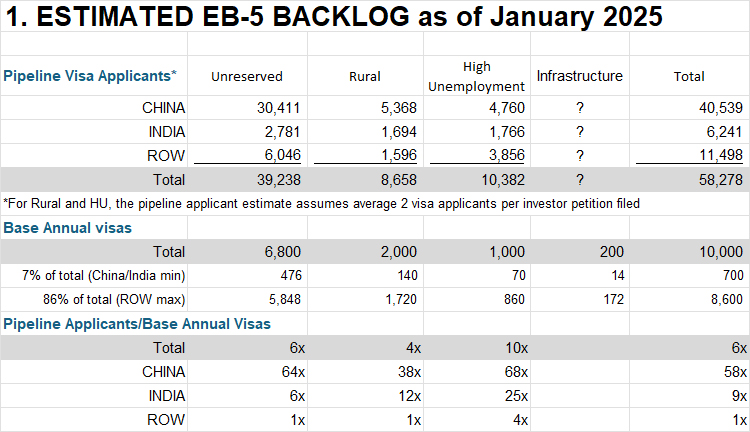

The big picture of EB-5 demand shows approximately 60,000 people in the pipeline for visas available at a base rate of 10,000 per year. (“In the pipeline” means people associated with investors who started the EB-5 process by filing I-526/I-526E, and now somewhere in the process between petition filing and receiving a conditional green card.) The EB-5 demand picture is further complicated by multiple TEA and country categories, which affect which applicant could qualify for which visa.

Table 1 summarizes the estimated EB-5 backlog as of January 2025. This includes legacy EB-5 applicants who started the process before RIA passed in March 15, 2022, and now still waiting for Unreserved visas. And the backlog includes nearly all EB-5 applicants with priority dates since March 2022, because Rural and High Unemployment visa issuance is just now finally getting started as of FY2025.

Let’s start with a few incorrect ways to interpret Table 1 above. It’s easy to get confused by these factors: how country caps do and do not limit visa allocation, options for TEA investors to change lanes and choose Unreserved visas, how wait time estimates apply to a variety of priority dates, and whether or not investors born outside China or India need to worry about visa availability.

| Incorrect Interpretation of Table 1 | Correction |

| X — The Rural visa wait time is 4 years for a January 2025 investor, because by January there were 4x more pipeline Rural applicants than base annual Rural visas. | Correction — Consider country-specific visa allocation, not only total category supply and demand. The country cap limits affecting China and India EB-5 mean that the expected Rural visa wait would be much longer than 4 years for China and India, and less for applicants from ROW countries. |

| X — The visa wait time for the last China Unreserved investor is 64 years, because China Unreserved demand exceeds annual Unreserved visa supply under the 7% country cap by 64x. | Correction — The 7% country cap is a base, not a necessarily a ceiling, for high-demand countries. China has been able to count on getting many more than 7% of EB-5 visas because rest-of-world demand is normally never sufficient to use the maximum Unreserved visas available on a priority basis to ROW. |

| X — The visa wait time for a China Rural investor is 38 years, because China Rural demand exceeds annual Rural visa supply under the 7% country cap by 38x. | Correction — 38-year visa wait times would only be possible if demand continued to grow and all Rural investors ultimately claimed Rural visas. But this is unlikely — given that Rural investors also have access to Unreserved visas that will be available to China in much less than 38 years. |

| X — If I wasn’t born in China or India, there are no limits on the EB-5 visas available to me. I don’t need to worry about backlogs or retrogression. | Correction — Only China, India, Mexico, and the Philippines are subject to country-specific visa limits — but anyone can still run up against category limits. If 3,000+ High Unemployment Rest of World applicants request HU visas in a year with <1,000 HU visas available, then 2,000+ of those ROW applicants will be stopped by the Visa Bulletin and need to wait for a visa number. This scenario is on track to happen, given pipeline ROW demand for HU. |

| X — If I’m a Canada-born High Unemployment investor with January 2025 priority date, my visa wait time is 4 years, because ROW demand for High Unemployment visas exceeds maximum annual HU visa supply to ROW by 4x. | Correction — 4-year visa wait times for Rest of World High Unemployment investors would only be the reality if all HU investors ultimately claimed HU visas. But this is unlikely — given that HU investors also have the option to request Unreserved visas, and Unreserved will be available to ROW in less than 4 years. |

| X — If I’m a Canada-born Rural investor with January 2025 priority date, my visa wait time is 1 year, because all ROW Rural applicants could fit in one year of ROW Rural visa availability. | Correction — Regardless of visa supply, the Canada-born Rural investor will likely wait far longer than a year for a visa due to the separate issue of USCIS and consular processing delay. The real-life wait for a visa is the wait for a visa number (as a function of quota limits) or wait for USCIS/DOS processing (as a function of operational constraints), whichever proves longer. |

| X — If I’m an investor from China or India since January 2025, I have a chance to get an EB-5 visa in less than four years. | Correction — Considering every option to optimize visa availability across TEA categories and around country limits, I still see no clear path for a 2025 investor from China or India to get an EB-5 visa in less than four years. Except by lucky non-FIFO processing, or unless the as-yet undocumented Infrastructure category proves to have had low demand. |

| X — If I’m an investor from China or India in 2025, I’ll definitely qualify for an EB-5 visa sooner as a Rural investor than as a High Unemployment investor. | Correction — At some point, the expected wait for an Unreserved visa will be less than the wait for either a Rural or HU visa. When that point is reached, the initial choice between Rural or HU investment becomes less important because the investor may count on ultimately requesting an Unreserved visa regardless of where he invested. This point may already have been reached. (For China and India-born investors in 2025, Unreserved will almost certainly be available earlier than HU visas. Unreserved may or may not be available earlier than Rural visas depending on future Rural demand from ROW.) |

| X — There’s no demand or backlog yet for Infrastructure visas. | Correction — Infrastructure investors exist, according to anecdotal evidence. Table 1 is only blank for the Infrastructure category because USCIS hasn’t reported data for it yet. |

| X — Table 1 describes backlogs and wait times that apply to me, regardless of when I started the EB-5 process. | Correction — Table 1 gives a picture of the backlog as of one date – January 31, 2025 – and thus applies specifically to people whose priority date is 1/31/2025. Someone with an earlier priority date faces a shorter backlog/wait time, and someone with a later priority date faces a longer backlog/wait time. |

| X — Table 1 is not valid, because the Base Annual Visas line does not include extra carryover visas. | Rural and High Unemployment visa availability in 2022-2024 is not counted in the current backlog reduction calculation because — although technically available — those visas were not issued. Reserved visa issuance is getting started as of 2025, though still at a low volume despite high limit. I decided that simply counting base annual visas from 2025 can make sense, because the future above-base visas thanks to carryover may ultimately (approximately) counterbalance initial below-base visa issuance from this year due to processing delays. |

(If you’d like a refresher on country caps and options for TEA investors to request Unreserved visas following I-526E approval, see Q5-Q14 from my Q&A published by CanAm last year.)

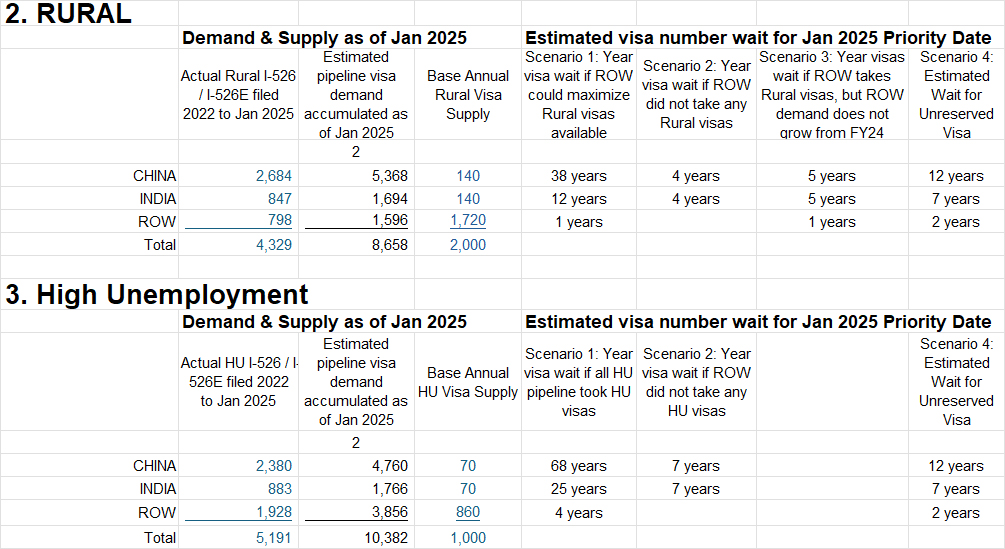

In revising my backlog analysis model, I tried to account for country caps, consider scope for visa allocation above country caps, account for the possibility of changing lanes between Reserved and Unreserved categories, model scenarios depending on whether applicants elect to change lanes, and then replicate all that for a variety of priority dates. Whew. Here’s a screenshot of summary projections for a January 31, 2025 priority date, showing the very different estimates that result depending on what assumptions one makes about future applicant behavior in choosing between Reserved and Unreserved visas.

Notes on the Scenarios:

- “Scenario 1” shows the maximum potential impact of country cap limits. The estimated wait time is the number that results from simply dividing pipeline demand by base annual visa availability in each category. Scenario 1 shows the wait time if all applicants stayed in their TEA lanes, and if China and India were actually limited to 7% of visas in each lane. This scenario could theoretically come true for High Unemployment unless and until many HU investors start selecting Unreserved visas, because HU has enough ROW applicants to limit China and India to 7% long-term. It could come true for Rural if future ROW Rural demand increases, plus all Rural investors ultimately request Rural visas. But this scenario won’t come true in real life, because HU and Rural applicants are free to make the Unreserved switch if desired. And obviously no one’s really waiting 68 years for a visa.

- “Scenario 2” models an unlikely but best-case scenario for China and India. What if 100% of Rest of World TEA investors switch to request Unreserved visas, leaving the entire Rural and High Unemployment visa allocations to be shared by China and India? In that case, China and India could get Rural and HU visas in FIFO order, without cap limits. Even in this best case, there could be a 4-year Rural visa wait and 7-year High Unemployment visa wait for January 2025 investors, based on the number of China and India-born applicants in the pipeline at that point compared with annual supply. And this case is unlikely to be fully realized, because ROW investors will (at least initially, before HU retrogression starts) lack personal motivation to request Unreserved visa allocation.

- “Scenario 3” models the outlook for China and India Rural if ROW Rural investors do take Rural visas, but the number of ROW Rural investors never grows enough to take all of the Rural visas technically available to ROW. For Scenario 3, I noted that ROW Rural I-526E filings in CY2024 were only high enough to absorb about 70% of the annual base allocation available to ROW on a priority basis. So Scenario 3 shows the “what if” Rural applicants from China and India can count on their own 7% each of annual Rural visas plus 30% of the Rural visas available first to ROW. I consider Scenario 3 relatively realistic, especially for Chinese and Indian investors with early Rural priority dates – but not dependable, given that ROW demand has been trending up. There’s no Scenario 3 for High Unemployment, because ROW demand for High Unemployment already well exceeds maximum visas available to ROW.

- “Scenario 4” gives the estimated visa number wait for a January 2025 Rural or High Unemployment investor who takes the first available Unreserved visa. The Scenario 4 estimate starts from quite pessimistic assumptions (about the longest I think the pre-RIA backlog could take to clear, the fewest Reserved visas issued in the meantime, and the most people jumping at an Unreserved switch.) But even with this pessimism, Scenario 4 might be the best visa timing hope for China and India-born investors with 2025 and later priority dates. At least, it’s a potential ceiling to keep in mind. For example as a January 2025 India-born investor looking at the above table, I’d be thinking “So my wait time for a visa number could theoretically be as long as 12 years or as short as 3.5 years in the Rural category, depending on behavior of other Rural investors – but in the worst case I should be able to fall back on the chance for an Unreserved visa in about 7 years.” (We may significantly revise Scenario 4 when the Department of State finally publishes the 2024 NVC Wait List and 2024 Annual Report. I’m told that these reports, which should’ve been published last month, are still pending due to litigation.)

Go ahead and download the EB-5 Backlog Analysis Excel file from the Timing Page to follow the data and formulas behind all these estimates, and to recalculate for different priority dates. You can also experiment with different family size assumptions. (Estimates for priority dates before January 2025 use a xlookup function with the table of historical monthly I-526E filing data. Estimates for dates since January incorporate a guess that future demand will replicate the CY2024 average — but you can change this assumption too if you like.) The model will have to be revised in the future when we get actual numbers after January. The model assumes steady monthly demand for prediction, but real-life demand fluctuation can end up making a huge difference in wait time for applicants with priority dates just weeks apart. If you notice any errors in my Excel, please email suzanne@lucidtext.com. I regularly edit the file as I find mistakes, get new data, or think of additional considerations.

I realize that the conclusions alone don’t look very helpful/actionable. (“My wait time could theoretically be between 4 and 38 years– what?”) And with so many moving parts and future assumptions involved, no one wait time estimate is firmly reliable. For example, the major question for all new China-born and India-born investors is how long it will take the legacy pre-RIA Unreserved backlog to clear. That time could prove years earlier than the pessimistic estimate in this model if on-going ROW Unreserved visa usage proves lower than I currently estimate based on recent trends, or if many legacy applicants recorded in old data reports have actually dropped out by now (or will). But even with the questionable conclusions, I hope that the step-by-step process and calculations that I laid out help to illuminate how wait-time-shaping factors work. And I hope that the bottom line is clear: EB-5 needs more visas.

Please join and donate to AIIA so that we can keep getting data to support ongoing analysis.

If you’d like a personalized consultation to discuss the analysis, you can schedule a Paid Timing Consultation here.

You’re invited to join me at a webinar that Carolyn Lee is hosting on May 30 at 2 ET: Latest EB-5 Numbers: What Do They Say About EB-5 Visa Backlog? This topic is so complicated that it’s easy to get lost in the weeds and lose a sense of urgency. I appreciate Carolyn’s efforts to keep EB-5 backlogs in focus as an urgent issue.

And a final caveat: my analysis has to assume FIFO order and average results. In my analysis, “wait for a January 31, 2025 priority date to get a visa” equals “time required for everyone pending in the same queue with PD before 1/31/2025 to get visas.” But real life is not quite FIFO, as illustrated in AIIA’s important new data release: AIIA FOIA Series: Post RIA Petition Approval Statistics for January 2025. The distribution of approvals in AIIA data shows that a few petitions are getting luckily picked out and processed earlier than others. The lucky few who reach the visa stage early/out of order have a chance to snag a visa before others with earlier priority dates, and before the date that would be calculated in my model.

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

expected Wait time for Indian investor file for EB 5 visa , application done on Dec 23 ,under high unemployment area

I set up the EB-5 Backlog Analysis file for just this kind of question. You can download the Excel file from the second link on this page https://blog.lucidtext.com/eb-5-timing/. Open the file and go to the HU tab, then enter your Dec 2023 date into cell D15. The model will then pull out the estimated number of pipeline applicants accumulated as of December 31, 2023, and calculate the three scenarios I discuss in the post for when visa numbers might be available for that priority date.

Hi Suzanne, Thanks a lot for putting such a detailed calculations. I entered my priority date as 10 March 2024 in Rural and it shows India 2031 (scenario 1) or 2027 (Scenario 2). but i observed that it does not consider how many visas have been already issued. If that info is available and can be considered, visa availability year will be reduced a lot.

Total Visa demand for India Rural till March 2024 is 808 from March 2022. for this, visa availability is showing as 2031 (scenario 1). Should it be also from March 2022 as like visa demand numbers from 2022. I mean right now (E32=$E$34+C32/D32) where E34 = 2025. Shouldn’t E34 be 2022 ?

I should have explained this in the post. Rural visas have been authorized since 2022, but — due to the separate issue of USCIS and DOS processing constraints — no Rural visas were issued in 2022 or 2023, and apparently only a few dozen were issued in 2024. (We’ll know 2024 for sure when the Visa Office 2024 Annual Report is published, but the DOS monthly and USCIS I-485 reports make the numbers look negligible.) Reserved visa issuance has started to pick up since October 2024, which is why I use 2025 as “Year 0” when considering backlog reduction. So far 2025 is on track to fall far below the available quota, but I’m hoping that 2026 will be able to bring 2025+2026 up to the average thanks to more applicants having I-526E approvals by 2026 and carryover of unused visas from 2025.

Will there be any non-reserved visas left for 2024 and available until 2026?

Will there be any carryover non-reserved visa places in 2026?

You are right to remind me about visa carryover to Unreserved in FY2026. My previous Unreserved calculation did not account for FY26 carryover, but it looks likely to happen given low Reserved visa issuance in so far in FY2025. Based on what we’ve seen October 2024 to March 2025, I might guess that about 500 High Unemployment and about 1,500 Rural visas will be issued by the end of FY2025. If that’s the case, then there would be 1,676 unused Reserved visas to carry over to Unreserved in FY2026.

What is the standard for setting the dates in Table B? How much more than Table A?