FY2025 Q3 processing data analysis

October 15, 2025 2 Comments

This is the first of a series of posts about USCIS receipt and processing data for FY2025 Q3 (April to June 2025), now published on the Immigration and Citizenship Data page. I’ll start with charts highlighting significant points from the All Forms report.

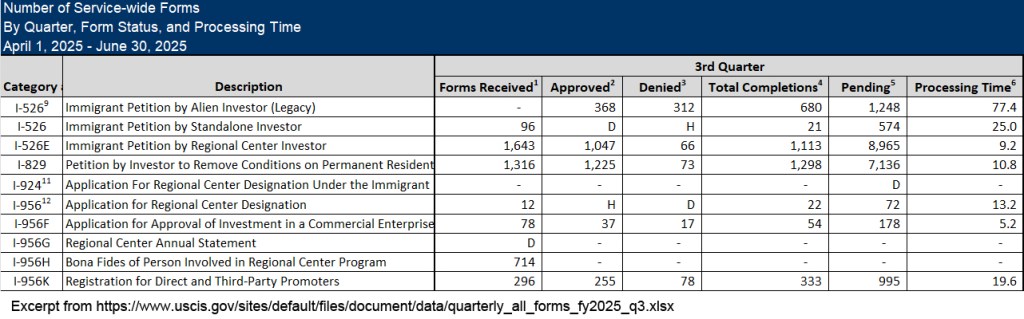

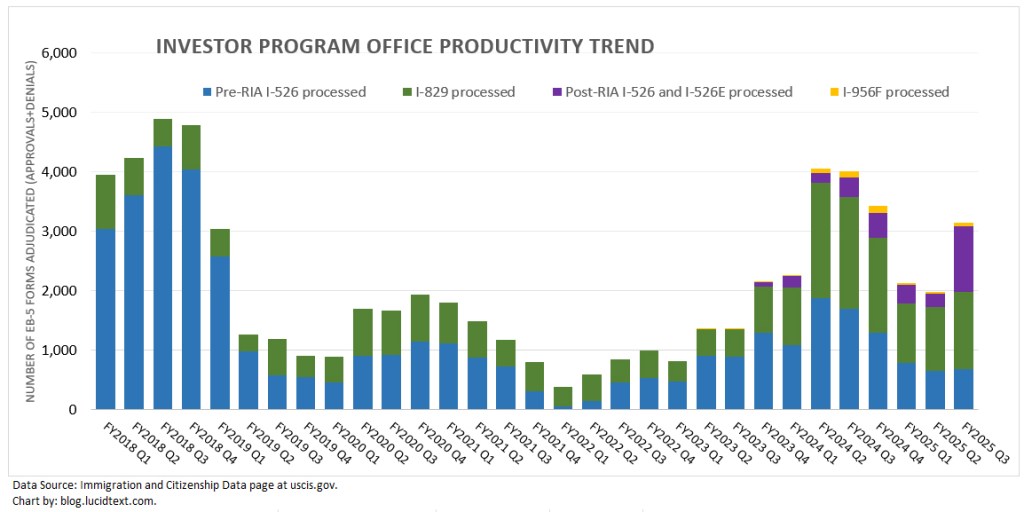

Overall Processing Productivity

I had been alarmed by the downward trend in EB-5 processing volumes, and happy to see a significant upswing in Q3 — primarily driven by increase to the number of post-RIA I-526 and I-526E processed. It’s good to see the Investor Program Office using the processing resources it evidently has, considering past volumes.

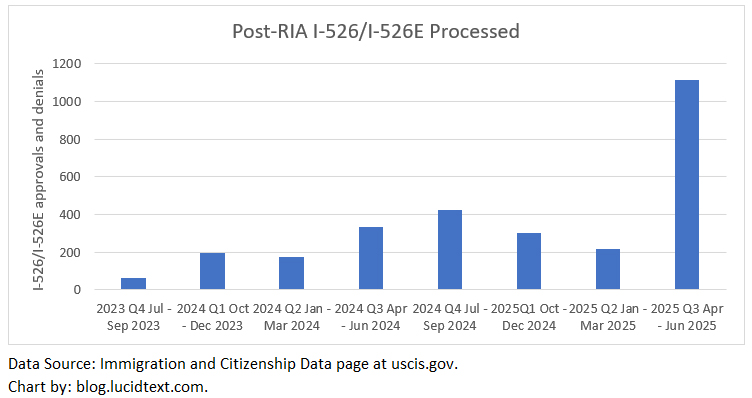

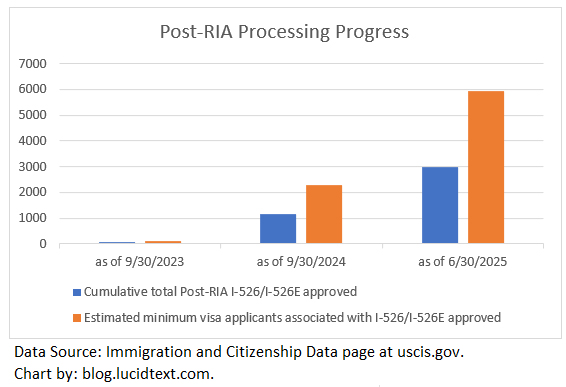

Post-RIA Processing Volume Trend (I-526 and I-526E)

The spike in post-RIA I-526/I-526E processing could well have generated more than enough qualified applicants by now for all 4,000 Rural and 2,000 High Unemployment visas available in FY2026. This is particularly true if high adjudication volume continued into Q4 — and I expect it did, considering that the “net backlog” report indicates over 3,000 I-526E actively in process of adjudication as of Q3. But I’m not certain, because the breakdown of approvals by TEA category is unreported. And we don’t have data yet for the other factor needed to predict retrogression: Has Department of State also increased its processing volume, thus allowing qualified applicants to get matched with visas? So there is not currently a data-based answer to the question of when the Visa Bulletin will have cut-off dates for Rural and High Unemployment.

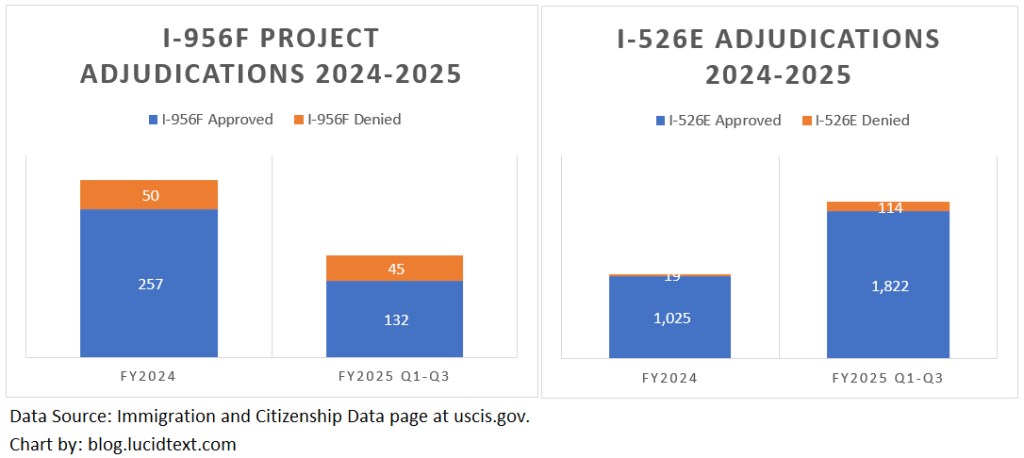

Post-RIA denial trend

The FY2025 year-to-date section of the USCIS report shows 114 I-526E denials (just 6% of total processed) and 35 post-RIA direct I-526 denials (75% of total processed). Apparently, USCIS is currently mostly processing regional center cases they can approve and direct cases they can deny. Direct EB-5 has always required very careful preparation, and I’m happy to report that two of my business plan clients were among the handful of direct I-526 that got approved in 2025. Regional center adjudications are now divided into two forms, with projects first assessed in I-956F and then investors in I-526E. When projects get denied, I-526E denials will follow for investors in those projects. USCIS reported denying 50 I-956F in FY2024, and 45 I-956F in FY2025 YTD (20% of total projects adjudicated in 24/25). Maybe USCIS is waiting for project denial appeals before pulling and denying the I-526E for investors in those 95 projects.

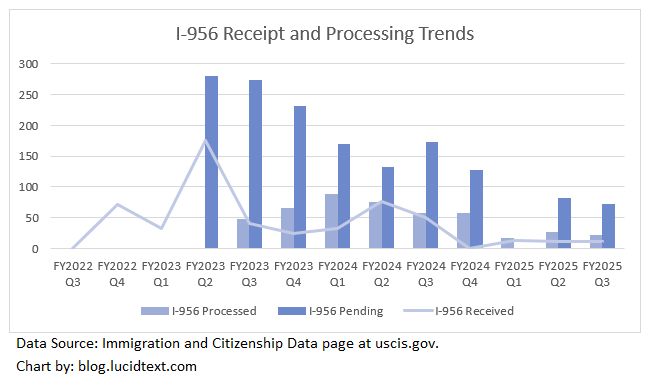

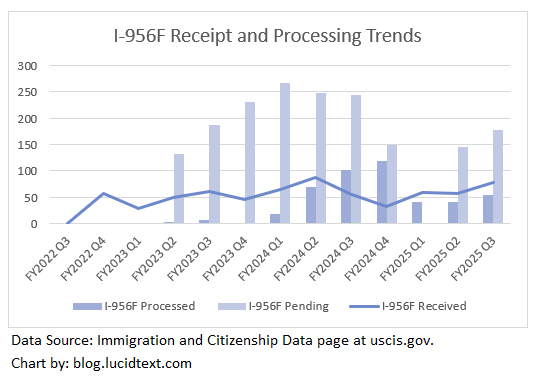

Post-RIA Processing Trend (I-956 and I-956F)

I-956 regional center application volumes remain low. I-956F project application processing has dipped below receipt numbers as of 2025, causing the backlog to inch up again.

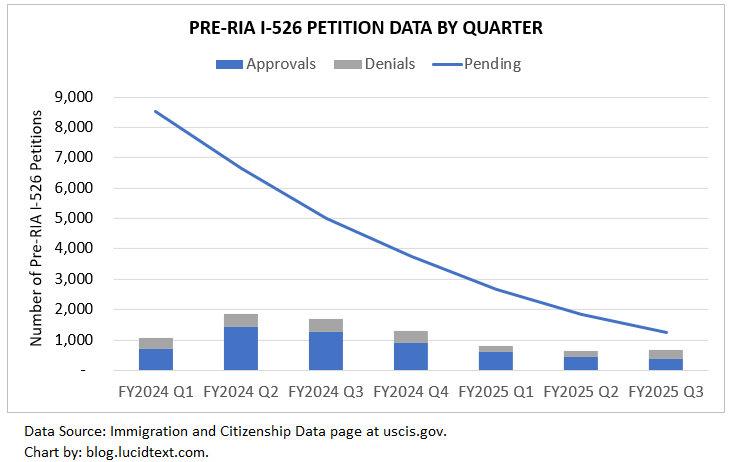

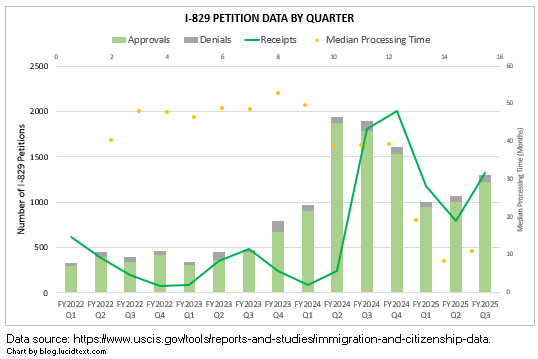

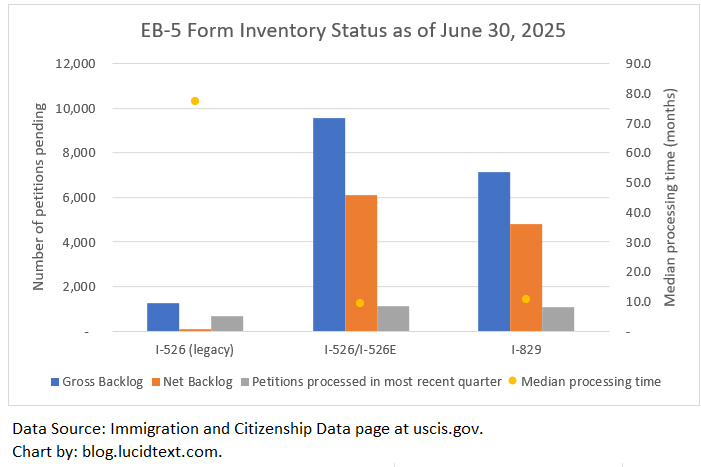

Pre-RIA Processing Trend (Legacy I-526 and I-829) and Processing Times

USCIS has nearly finished clearing the legacy I-526 inventory (with the “net backlog” now down to just 100 forms). The reported legacy I-526 processing time is extremely high only because recent decisions have been on old China I-526 held back by visa availability. For I-829, quarterly processing volumes continue to nearly keep pace with receipts. So the I-829 backlog has been holding steady, neither growing nor shrinking overall. With 7,000+ I-829 pending, how can the median I-829 processing time be only 10.8 months, as reported? Evidently, USCIS has not been processing I-829 in FIFO order. I assume this reflects the impact of Mandamus actions. Reported processing times (which reflect timing for the subset of cases that DID get happen to get adjudicated during the period) should always be looked at in context of the volume and age of pending petitions not getting adjudicated.

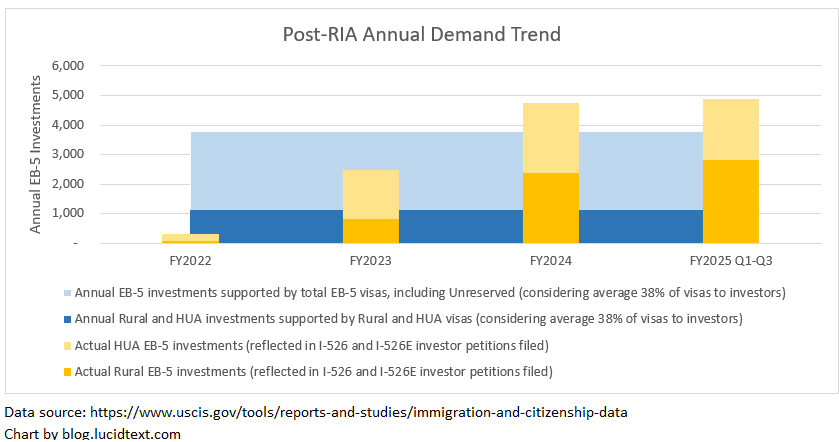

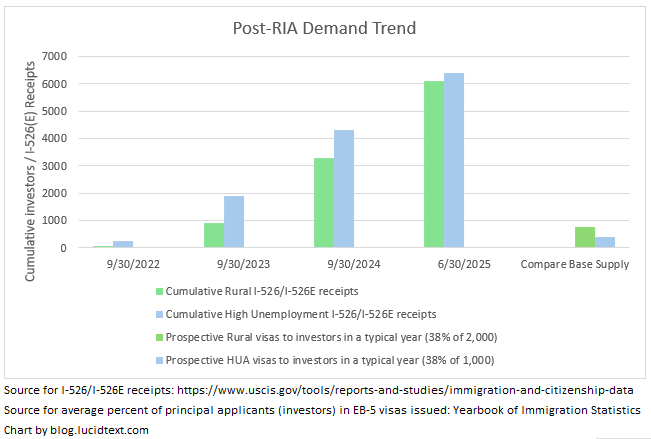

Post-RIA Demand Trend

I’ll write a separate post on the TEA-specific new Q3 data and backlog analysis, but I will start with a couple charts to contemplate. Demand from Rural and High Unemployment investors has grown extremely far above the level possible support with timely visas (with 2025 levels proving even higher than 2024). Especially considering that only 38% of EB-5 visas have historically gone to investors, on average, while the remaining get absorbed by spouses and children. Country caps, Unreserved visas, and non-FIFO processing give space for complicated mixing and matching such that some investors won’t have to wait as long as others for visas. But the overall picture shows EB-5 demand so high by June 2025 that visa wait times would exist even if post-RIA investors had access to the full 10,000 or so annual EB-5 visas, not to mention competing for the 32% of visas set-aside. 2026/2027 will have to see either visa relief or a demand crash.

Do you benefit from this analysis? Consider supporting all the work it requires by making a contribution to the blog.

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

Hi Suzanne, the November visa bulletin has published but it remains unchanged for China unreserved. This is so wired, is there any data to explain such situation? Why new fiscal year didn’t bring new visas for EB5?

The new fiscal year brought more visas, but Department of State apparently already has enough China-born applicants ready to take the new visas. The visa bulletin only moves when it starts running out of qualified applicants within one date, and needs to make more applicants eligible. Also, since the China Unreserved visa supply depends primarily on how many visas are going to be left unused by ROW, DOS is more likely to move China dates later in the fiscal year when it has a better idea how many visas are going to be left on the table after satisfying ROW demand.