Proposed new fee rule (lower EB-5 fees, Form I-527 for subsection M, integrity fees and RC compliance status, I-829 technical amendment)

October 22, 2025 2 Comments

Department of Homeland Security has published a proposed rule for Employment-Based Immigrant Visa, Fifth Preference (EB-5) Fee Rule.

Summary

The 2025 EB-5 fee rule proposes to LOWER EB-5 form filing fees, primarily based on allowing IPO to keep EB-5 fee revenue instead of also helping to fund other USCIS functions. DHS foresees increased resources and continuing efficiency improvements at IPO, considering RIA goals, but offers no timely processing guarantees. (See below for more detailed discussion.)

The rule proposes a new Form I-527. “An investor may file this form if they filed a Form I-526 before March 15, 2022, and are seeking to retain eligibility under section 203(b)(5)(M) of the INA because their regional center has been terminated or their NCE or JCE has been debarred and they do not otherwise continue to be eligible notwithstanding such termination or debarment.”

The promised “technical amendment” turns out to be about I-829, and “specifies that where the dependent family members cannot be included in the Form I-829 petition filed by the principal investor because that principal is deceased, all dependents (spouse and children) of the deceased investor may be included on a single Form I-829 petition.”

I expect that the liveliest public comments may be on the section of the rule discussing integrity fees, and the fundamental question of whether there’s any compliance distinction between a “previously-approved regional center” and a “regional center designated under (E).” No, suggests the rule. “DHS reiterates that the statutory language is clear in that these new provisions of the INA added by the EB-5 Reform Act, including the required fees and penalties, also apply to previously designated regional centers as of the date of enactment.” The rule also offers detailed discussion (which I couldn’t quite follow) of how to define “investors” for the purpose of calculating integrity fee payments. The rule proposes a minimal inflation-based increase to the integrity fee amount.

The rule is open for public comments until December 22, 2025. And then “After considering comments on this rule, DHS will complete and publish a final fee study that will take effect 60 days after publication.” So we are still months away from new fees, but the proposed rule publication is an important milestone.

Fee Change Discussion

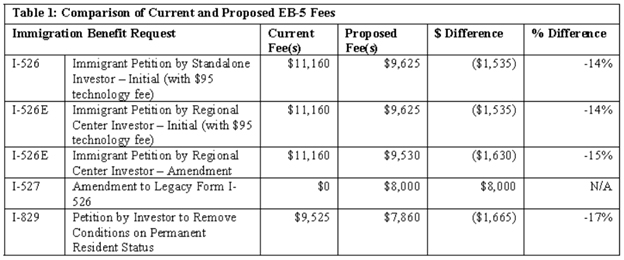

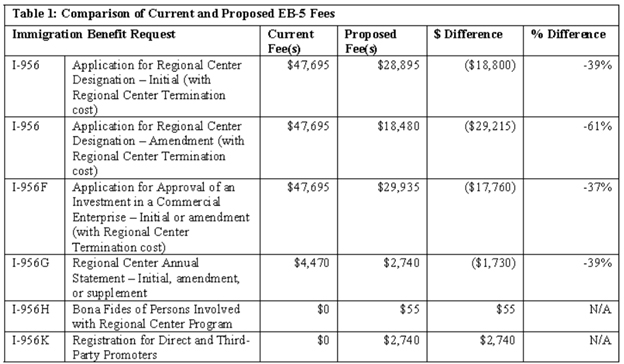

DHS proposes to lower filing fees for most EB-5 forms.

The single major factor in this recalculation is a decision to NOT use EB-5 filing fees to cover non-EB-5 costs. As I pointed out in my analysis of the 2022/2023 fee rule, DHS previously set EB-5 fees to allow collecting over $20 million that would be reallocated to USCIS budget needs outside EB-5, to help cover the cost of no-fee/low-fee benefit processing. The 2025 EB-5 Fee Rule explains “the proposed fees are lower than the current fees because the proposed fees do not include any additional costs for processing benefit requests with no fee or a reduced fee, thus reducing the fees overall.” DHS made this decision because doing cost reallocation outside EB-5 again “would likely result in litigation,” and because the reallocation from EB-5 is a drop in the total USCIS budget that might also be covered by USCIS balances and reserves and new appropriations in the “One Big Beautiful Bill.”

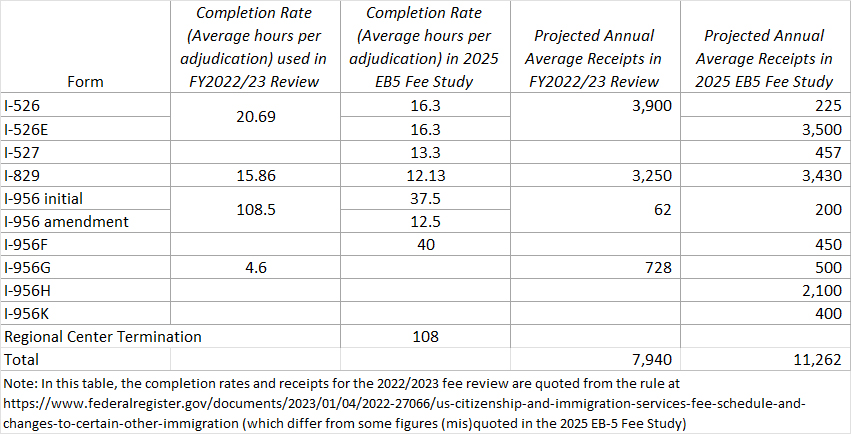

Another factor in the 2025 fee recalculation is that DHS is projecting slightly higher EB-5 receipt numbers than assumed in the 2022/2023 fee review (including remembering to account for all the various I-956 forms) and slightly lower average hours per adjudication than assumed in the previous fee study. If one assumes more form fees and lower time commitment per case, one can afford to consider lower fees.

Basically, the methodology and goal behind the 2025 EB-5 fee study is the same as the general DHS fee-setting methodology, with a focus on cost recovery rather than performance. The goal is “to assess whether the current EB-5 fees meet full operating-cost recovery consistent with the EB-5 Reform Act requirements.” The 2025 fee study does reference RIA timely processing targets, but points out that “Completion Goals Are Not Requirements.” The rule explains that “consistent with the statute, DHS is not proposing to codify any processing deadlines, or any consequences for missing those processing time goals. USCIS will strive to process EB-5 requests as quickly and efficiently as possible to meet the time goals referenced in the EB-5 Reform Act and on which the fees in this rule are based, while keeping the integrity of the program utmost in mind.”

The 2025 Fee Study makes welcome comments about USCIS efficiency improvements, and plans to invest in more staff at IPO. The rule specifies a goal to reach “a total of approximately 334 employees (FTEs) across multiple USCIS offices (237 FTEs in IPO, nine (9) FTEs in Administrative Appeals Office, two (2) FTEs in Office of the Chief Counsel, 86 FTEs in Fraud Detection and National Security Directorate).” For reference, IPO Chief Emmel previously reported that “All told, we have around 180 IPO staff and 36 IPO Fraud Detection and National Security staff for a total of 216 employees on-board as of October 1, 2022.”

Is it possible that DHS will not only lower EB-5 filing fees but also increase IPO resources to the point that we see processing improvements? The fee rule is ambiguous on this point. The rule disclaims responsibility to meet RIA timely processing time goals, and doesn’t formulate a specific plan to meet the goals. But processing should improve in fact, if the IPO budget and personnel are indeed increased as contemplated in the rule. All the better if this can be accomplished simply by letting IPO keep all EB-5 fee revenue, with no increase to EB-5 filing fees.

Is this analysis helpful to you? Consider supporting my work on the blog with a contribution through PayPal or Stripe (Link or credit card).

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

Stripe worked for me. Bought a cup of coffee for you.

Received, thank you!