H.R.4530, Resources, RC List Update

February 12, 2016 Leave a comment

H.R.4530 Introduced

Even as Representatives Goodlatte, Conyers, Issa, and Lofgren (who worked with Senators Leahy and Grassley on their legislation last year) were speaking in yesterday’s House EB-5 hearing about how they think EB-5 incentives are misused and need to be re-oriented, representatives Polis and Amodei introduced H.R.4530-EB-5 Integrity Act of 2016, a bill that proposes to keep current EB-5 incentives in place. I’ve added the bill to my comparison chart, but you don’t need to read it; H.R.4530 is a carbon copy of Senator Flake’s S.2415 (and FYI entirely different from the H.R. 616 American Entrepreneurship and Investment Act of 2015 introduced by Polis and Amodei last January). I don’t know whom to cheer in this legislative mix. The Grassley/Leahy camp bill included at least one provision that would touch and could hurt (sometimes even fatally) each segment of the regional center world, while the Flake/Polis camp bill is crafted to ensure that the current winners don’t get their boats rocked and keep winning, with TEA incentives and the investment amount the same and the kind of integrity measures that conveniently double as anti-competitive measures. Diversity in the regional center world can be a problem, because fragmented markets are hard to work with and small-scale players have a relative probability of being unprofessional if not rogue and causing trouble. On the other hand, diversity means that EB-5 is relatively likely to fund the kind of projects that Congressional representatives want to see to help justify the regional center program — the hotels in third tier cities, the logistics companies in blighted industrial areas, the affordable housing, the entertainment and agricultural projects in rural areas, and so on. If regional center investment becomes all small safe loans to luxury developments in gateway cities, then immigrant investors will benefit but the American public, media, and Congress may turn against what looks like essentially a low-bar green card purchase transaction plus jobs-neutral government subsidy for attractive projects that would’ve proceeded anyway, just more expensively without the green card incentive to lower capital costs. On the other hand, the cause of integrity would not be advanced by deciding to limit the regional center program to unattractive projects entirely dependent on hapless foreign investors, or providing too much leeway for issuers that lack resources to operate professionally. If I were called to testify, I don’t know what changes I’d suggest to maximize EB-5’s potential benefits and minimize risks.

Resources

This quarter’s editions of the Regional Center Business Journal and EB-5 Investors Magazine (so far just out in paper form, but to be posted here soon) both have a number of great articles. In RCBJ, I particularly appreciated “What we Learn From SEC Investigation” by Ronald Fieldstone and Jay Rosen, who provide a comprehensive review of the types of violations that get investigated by the SEC, the specific activities that are focus of investigations, and the SEC investigation process from subpoena through discovery, deposition, negotiation and settlement. Lili Wang writes helpfully in RCBJ about the question we all ask “What Do Chinese Migration Agents Really Want?”, and EB-5 Investors Magazine also takes up this theme with two interesting migration agent interviews. Gregory White, Mark Katzoff and Angelo Paparelli authored an article for v.3.3 EB5 Investors Magazine (that I hope will soon be available online) on the important topic of “Avoiding the Inadvertent Investment Company.” The article describes how a regional center or issuer may avoid (and what will happen if it doesn’t avoid) being tagged as an investment company, including possible rescission, ineligibility to satisfy the EB-5 “at risk” capital rules and a duty to register as an investment advisor. EB5 Diligence also had a webinar this week on the topic Are Regional Centers Acting As Unregistered Investment Advisors? Another hot topic is the “rent-a-center” model for regional center investment, which has become increasingly popular and has also appeared in the cross-hairs of some legislative reform proposals. Rohit Kapuria has posted a thoughtful article Is the EB-5 Regional Center “Pure” Rental Model Sustainable?, and EB5 Projects will host a free webinar on 2/23 concerning Immigration & Securities Issues with Renting Buying & Selling an EB-5 Visa Regional Center.

USCIS Engagement Notes

USCIS has updated the 2/3 EB-5 Stakeholder invitation page with copies of the written opening statements made by Nicholas Colucci, Julia Harrison, and Lori MacKenzie. Also FYI I keep a master directory of USCIS EB-5 stakeholder meetings and a handy searchable PDF compilation of all published meeting notes (for those times when you can remember USCIS discussing a topic but forget where and when).

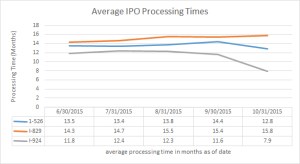

Processing Times

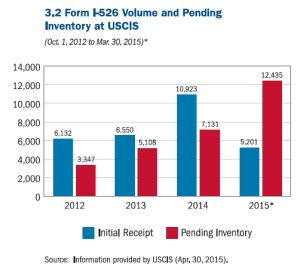

Not that we put much stock in IPO processing time averages (at least not without keeping a 10-month or so standard deviation in mind), but USCIS Processing Time Information has been updated as of 12/31/2016: 16 months for I-526, 16.2 months for I-829, and 8.5 months for I-924 (all up about 0.5 months from the previous report).

Regional Center List Changes

Additions to the USCIS Regional Center List, 01/28/2016 to 2/10/2016.

- Bluegrass International Fund, LLC (Indiana, Kentucky): www.bluegrass-fund.com

- East Coast Regional Center, LLC (New Jersey, New York)

- Howard Hughes Hawaii Regional Center, LLC (Hawaii)

- Mid-Atlantic Regional Center (Connecticut, Delaware, Maryland, New Jersey, New York, Pennsylvania): aseb5.com

- Yellow Rock Regional Center of Washington, LLC (Washington)

Renamed:

- Florida East Coast EB5 Regional Center LLC (former name United States Growth Fund, LLC) (Florida)

- Prosperity Regional Center (former name U.S. Prosperity Regional Center) (Florida)

- Investus LLC (former name New Mexico Foreign Investments LLC) (New Mexico)

- New York Dream Regional Center LLC (former name Tri-State USA Regional Center) (New York)