New EB-5 Guidance Memo

January 2, 2013 8 Comments

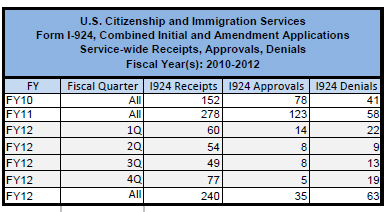

In January 2012, I wrote a post about the Regional Center applications reported to be “on hold at USCIS headquarters pending resolution of an issue.” Now it’s January 2013, and many of those same applications are still on hold. We know the issue now, or some of the issues, but can we see a resolution? What can we take from the guidance memo recently released by USCIS?

It appears to me that the 12/20/2012 “Operational Guidance for EB-5 Cases Involving Tenant-Occupancy” is a formal presentation of the message that USCIS gradually released through Requests for Evidence and stakeholder meetings throughout the year. Specifically: An enterprise that invests EB-5 capital in commercial real estate development may count tenant employees as created jobs provided that it demonstrates a “reasonable causal link between the EB-5 enterprise and the job creation.” The causal link may be 1) financial (based on significant investment in the job-creating tenants), or 2) “facilitation-based” (based on removing a significant market-based constraint to the tenant job creation). In either case, the jobs must be new, not merely relocated. The memo allows that the I-924 application may analyze potential tenants by industry category rather than identifying specific tenants. It also grants that modifications to tenant arrangements between I-526 and I-829 do not necessarily constitute a material change. The underlying message is that USCIS did not change any policy or object to anything in principle (i.e. don’t sue us), but is only raising fact-specific questions about tenant job counts.

If you followed RFEs and stakeholder meetings last year, then you already know the basic principles presented in the guidance memo. What’s new? The memo clarifies that the options for showing nexus between investment and tenant jobs are either/or options rather than both/and requirements. “For applicants and petitioners that seek to utilize a facilitation-based approach, USCIS will not require an equity or direct financial connection between the EB-5 capital investment and the employees of prospective tenants.” The memo includes a form of the facilitation approach appropriate for a high unemployment area (which the tenant occupancy RFE omitted to do). The flexibility on I-924 application detail and material change are also new concessions.

I appreciate that USCIS has issued a formal, public statement about the question of counting tenant jobs. The memo articulates general policy, and states that “whether an applicant or petitioner has demonstrated that an EB-5 enterprise caused the creation of indirect tenant jobs will require determinations on a case by case basis and will generally require an evaluation of the verifiable detail provided and the overall reasonableness of the methodology as presented.” The memo leaves the adjudicators and us to figure out what constitutes overall reasonableness. I’d like to know how adjudicators understand the guidance to look for “evidence backed by reasonable methods that map a specific amount of direct, imputed, or subsidized investment to such new jobs.” (p 10-11 in the 5/1/2012 stakeholder meeting summary provide some detail, but I don’t know whether that Q&A reflects current USCIS thinking). I’d like to see examples of applicants succeeding at the task “to project the number of newly created jobs that would not have been created but for the economic activity of the EB-5 commercial enterprise.” I’d like to see to what extent applicants must go to “demonstrate that the economic benefits provided by a specific space project will remove a significant market-based constraint.” I want to know whether it’s possible to take advantage of the theoretical flexibility to not identify a tenant at the I-924 stage when one has to demonstrate in verifiable detail how many new jobs that unidentified tenant will create, and state a minimum four-digit NAICS code for the industry type. I want to know details on the settlement of Courtney Carlsson, et al v. United States Citizenship and Immigration Services, and whether USCIS compromised on any issues raised in the Complaint on behalf of American Life investors whose I-526 petitions were denied in 2012.

The new guidance memo assures us (probably with Ira Kurzban in mind) that USCIS does not object in principle to counting jobs generated by tenants. That’s nice (and politic), but what I really want to know is whether it’s possible to count such jobs in practice. Based on the guidance provided, I can visualize an approve-able business plan for investment in a building that will house a new restaurant tenant that will receive start-up assistance. Certain build-to-suit scenarios in constrained markets also look do-able. I don’t think it’s clear yet how/whether the retail centers and office buildings that were a staple of EB-5 for years can now fit back into the equation. Developers are welcome to try to show “verifiable evidence” for “the number of newly created jobs that would not have been created but for the economic activity of the EB-5 commercial enterprise.” It remains to be seen whether economists and writers will be up for the challenge, and what adjudicators will make of our fact-specific arguments.

I think of applicants who filed Regional Center applications in 2011 and RFE responses back in Spring 2012, and who are still waiting to hear back from USCIS. We wrote many pages describing scenarios such as joint venture arrangements with identified tenants or funds for start-up expenses for prospective tenants. Responses included detailed market studies showing excess demand and constrained supply for specific types of commercial real estate in the local area, letters from identified tenants describing need for specialized space, and even pleas from local economic development officials detailing how proposed projects would fill an existing investment void in the area to generate new demand for the tenant business. When USCIS starts giving feedback on such responses, then I will start to get excited. So long as those applications continue to sit while someone figures out how to apply principles in practice, I consider that the “tenant occupancy” issues remain technically “unresolved at headquarters” despite the nice new memo.

May 2013 Update: USCIS responded to the tenant occupancy applicants that I mentioned above, and the result is not pretty. For details, see my post Tenant Occupancy Saga Continues (NOID Chapter).