RC Hearing, RC List Update

January 29, 2016 1 Comment

2/2 Hearing on the Regional Center Program

The Senate Judiciary Committee/Senator Grassley have titled next week’s hearing “The Failures and Future of the EB-5 Regional Center Program: Can it be Fixed?” Good heavens! No wonder journalists started calling me yesterday wondering what’s blowing up in EB-5, and disappointed to discover that this insider knows a thousand boring little problems but no big story of pervasive failure to justify such a hearing title. But tis the season for politics, and EB-5 can appear as a golden opportunity to bash immigration plus the wealthy plus real estate developers plus Commies plus New Yorkers all in one rabble-pleasing blow. And Regional Centers may just have to get in line with police officers and Muslim Americans as victims of our politicians’ inclination to profile entire communities based on a few isolated actors. If I were a typical regional center innocently engaged in unremarkable project finance, I’d be worried about a powerful Congressman asking “do you have a future and can you be fixed?” while under the impression that I’m failing and am inherently likely to be facilitating terrorist travel, economic espionage, money laundering, and investment fraud. Hopefully the hearing will call speakers who provide our leaders a more accurate impression of what’s actually going on in the regional center program. The hearing will stream live on the Senate Judiciary Committee website at 10 am EST on Tuesday Feb. 2.

New RCs

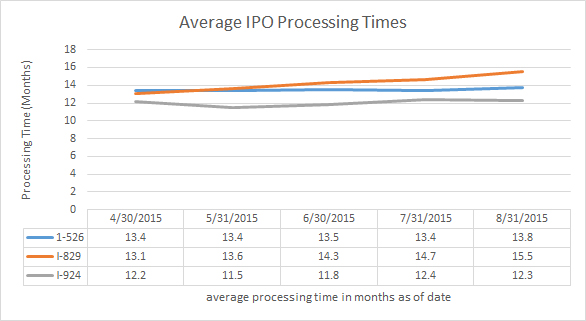

Meanwhile, USCIS continues to process EB-5 applications and petitions. The average posted I-526 processing time jumped to 15.5 months as of 11/30/2015 (up from 12.8 months reported as of 10/31). USCIS has also updated the regional center list, and posted a new PDF file that gives the identification number for each regional center. I can’t think how this could possibly help anyone (what we need, USCIS, is for you to please post the designation letters that show who’s behind these RCs and what you’ve approved them for), but the list with ID numbers is there FYI.Additions to the USCIS Regional Center List, 1/14/2016 to 01/28/2016.

- Ashcroft/Sullivan New England Economic Development Center (Massachusetts, Rhode Island): aseb5.com

- Liongate Regional Center, LLC (Washington)

- MCFI Nevada (Nevada):www.mcfiusa.com

Renamed:

- Central Western Regional Center LLC (former name USA Midwest Regional Center LLC) (Illinois, Indiana, Kansas, Kentucky, Michigan, Missouri, Ohio, Pennsylvania, Wisconsin)

- Green Card Solutions Regional Center (former name Shrimp House US LLC) (Florida)