Updates (I-829, Ombudsman, debt arrangements, PM, conference, Vermont, RC list changes)

July 16, 2018 21 Comments

Processing Times

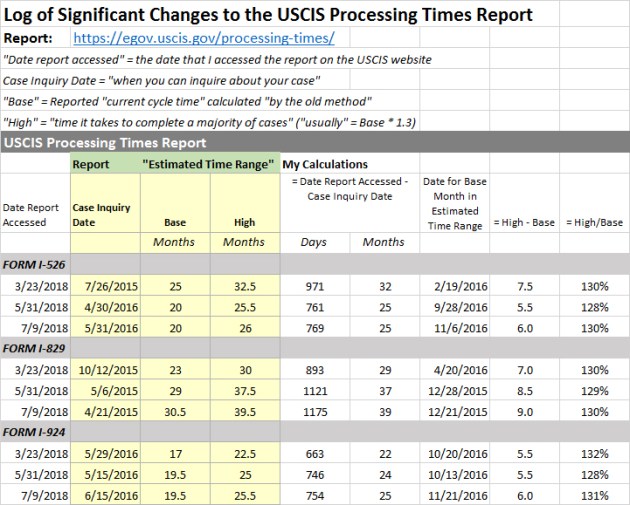

The USCIS page to Check Processing Times was updated last week with minor tweaks to the I-526 and I-924 time calculations, and bad news for I-829. Someone can inquire today about an I-829 petition “outside normal” processing times if he or she filed the I-829 petition 1,175 or more days ago. Statute mandates the service to make a decision on the I-829 within 90 days of the filing date or interview, but it’s currently taking three to four years to make a decision. IPO faces pressure from increased volume of filings and an increasingly tough process. Conditional green cards maxed out the limit starting in 2014/2015, and that surge began maturing to the conditions removal stage in 2016/2017. Even as I-829 filings increase in number, IPO has implemented several time-consuming integrity measures: in-person interviews of all I-829 petitioners, and site visits to 100% of job-creating entities in I-829 petitions. IPO attempted to address processing times problems in 2017 by creating a new team of economists and adjudicators specifically to handle I-829, but this team obviously needs help now. (This post copies emails sent by USCIS last month regarding I-829 receipt notices.)The USCIS processing times report has received three significant updates since it launched in March. (The report has a daily minor update: to add one more day to the Case Inquiry Date.)

2018 Ombudsman Report

The CIS Ombudsman’s 2018 Annual Report to Congress is a well-researched, well-presented document that I’d be proud to have written. The 2017 report made waves in EB-5 because it mentioned the 10+ year visa wait for Chinese investors, and many people in the industry found it expedient to imply that we didn’t know about the wait before that report. The 2018 report offers fewer occasions for real or feigned surprise, but does provide a solid summing up of the EB-5 program history and current status (page 48-56). I hope that Congress reads this report, as it gives a fair picture of challenges to EB-5 program effectiveness and integrity, and solid description and analysis of the substantial past, present, and planned steps taken to handle those challenges. Regarding the proposed EB-5 regulations, the Ombudsman makes a good point: “It remains to be seen whether these reforms will be sufficient to reassure those concerned about the increased oversight, or if they will have a chilling effect on participation.”

For anyone who has had problems with USCIS case processing and thought of contacting the Ombudsman for help, pages 3-5 of the report gives a nice explanation of how the Ombudsman handles inquiries. And I appreciated the detailed discussion of background checks on pages 28-32 and 57-58.

Debt Arrangements

USCIS continues to deny I-526 petitions based on finding that they include impermissible debt arrangements, while the industry continues to fight back to clarify what “invest” and “at risk” mean. This article presents arguments and distinctions that will be helpful to anyone in midst of the battle:

- At Risk, Debt Arrangement, Guaranteed Redemption: Important Distinctions (July 9, 2018) H. Ronald Klasko

Other relevant resources that I’ve previously linked here:

- IIUSA has included helpful analysis of challenges to investment structures and terms in its letter from IIUSA to USCIS regarding Major Issues Facing the EB-5 Industry.

- Ira Kurzban has published an article based on his success with Chiayu Chang, et. al., v USCIS “Federal Litigation: The Knockout Punch to USCIS’s Overbroad Policy on Redemption Agreements and Call Options?”

- My notes for an ILW call on 4/17 to discuss the “invest” requirement, and new USCIS challenges to equity with debt-like features. The notes link to the relevant decisions and cases, and summarize the fact pattern and arguments for each case.

Conference

Suzanne Lazicki will be at the 2018 EB-5 Investors Conference in Los Angeles next week. I’ll be speaking on a panel at 1 pm on July 23 (“The Right Fit – How Current and Future EB-5 Projects are Changing with the Market”), and available to meet in-person on July 23 and 24. Look for me to chat, or use this calendar to fix a time.

Policy Guidance

In a new Policy Memorandum dated July 13, 2018, USCIS Updates Policy Guidance for Certain Requests for Evidence and Notices of Intent to Deny. The memo, which will become effective on September 11, 2018, “provides guidance to USCIS adjudicators regarding their discretion to deny an application, petition, or request without first issuing a Request for Evidence (RFE) or Notice of Intent to Deny (NOID) when required initial evidence was not submitted or the evidence of record fails to establish eligibility.” This isn’t a major change, and not exclusive to EB-5, but a good reminder. Petitioners need to establish eligibility at the time of filing, and may not be able to depend on correcting major omissions in response to RFE.

Regional Center Termination

To date, USCIS has terminated 244 regional centers, mostly for inactivity, or for not filing the I-924A annual report. A handful have been terminated in connection with problems, including, last week, Vermont Agency of Commerce and Community Development. I’m particularly interested in the Vermont RC case, because it’s hard to imagine anyone doing more than Vermont has done to try to compensate for and recover from the oversights that allowed project fraud to occur under its watch. Vermont’s response to the Notice of Intent to Terminate challenged USCIS to be more precise about a regional center’s responsibilities for monitoring and oversight, and pointed out all the positive and responsible things the RC has done — including a plan to wind down the RC in an orderly manner that protects existing investors and prevents future problems. In response, USCIS makes that responsible plan a major plank in the denial decision: no future projects means failure to actively promote economic growth. Vermont plans to appeal. For more detail, see this VTDigger article, which ends with a link to the full USCIS termination notice.

Regional Center List Changes

Additions to the USCIS Regional Center List, 06/05/2018 to 7/16/2018.

- Allstates QSR Regional Center, LLC (Connecticut, District of Columbia, Massachusetts, New York, Pennsylvania)

- American Dream Group, LLC Regional Center (Washington)

- Art District Los Angeles Regional Center, LLC (California)

- Beresford Regional Center (California)

- Best Tire Center Regional Center, LLC (Texas)

- BridgeForth Southeastern Regional Center, LLC (Florida, Georgia, South Carolina, Tennessee)

- Gateway South Florida Regional Center, LLC (Florida)

- Keystone Great Lakes Regional Center, LLC: www.keystoneeb5.com (Illinois, Indiana, Wisconsin)

- Retail Equity Partners Regional Center Texas, LLC (Texas)

- U.S. Immigration Fund – CA, LLC (California)

- Xocolatl Xperience Regional Center, Inc. (Florida)

- Zhielo, LLC (Florida)

New Terminations:

- Charter Square Regional Center, LLC (California) Terminated 7/10/2018

- RGV EB-5 Regional Center (Texas) Terminated 7/10/2018

- Vermont Agency of Commerce and Community Development (Vermont) Terminated 7/3/2018 USCIS Termination Notice

- Idaho State Regional Center LLC (Idaho) Terminated 7/3/2018

- White Lotus Group Regional Center (Iowa, Nebraska) Terminated 6/26/2018

- Rota EB5 Regional Center (Commonwealth of Northern Marianas Islands) Terminated 6/21/2018

- AmerAsia EB5 Regional Center SF, LLC (California) Terminated 6/11/2018

- Utah Invest Regional Center, LLC (Utah) Terminated 7/3/2018

- California Pacific Regional Center, Inc (California) Terminated 6/7/2018

Discover more from EB-5 Updates

Subscribe to get the latest posts sent to your email.

Hi Suzanne

Thank you again for great analysis.

I applied in June 2016 and I am still waiting for petition approval. Our project got I-924 approval about a month ago. My Regional Centre is from well known big company with many approved projects. I suppose most of the people in my project still did not get approvals, so I am not an exception.

I wonder, is there any correlation between time of I-924 approval and time when petitions of this regional centre start to get approved? I will have case enquiry date in less than 3 weeks, I think several people or more in my project already got case enquiry dates, hopefully this will help.

Thank you very much.

I-924 approval is supposed to speed I-526 approval, but I-526 only benefit if IPO can match the investor petitions with the I-924 exemplar. You might confirm with the RC that IPO has been given a list of I-526 receipt numbers to go with the I-924. If not, this can still be done. See Julia Harrison’s comments on p 4-5 here https://www.uscis.gov/sites/default/files/USCIS/Outreach/Notes%20from%20Previous%20Engagements/PED_EB5EngagementTalkingPoints_11072017.pdf

Thank you very much, Suzanne.

Hi Vlad,

While I cannot speak for USCIS, I could give a bit of anecdotal evidence. Based on my/my clients’ recent experience, USCIS has been postponing adjudication of I-526s until the I-924 exemplar has been approved.

I have clients who invested in a project associated with a well-known RC as early as August 2016. The I-924 was approved in April 2018. In late May, USCIS sent a Request For Clarification asking for my firm to supplement our current I-526s with additional project documents that the RC submitted to USCIS to have the I-924 approved. In USCIS’s RFC email, they expressly stated that, “[N]one of the [I-526] receipts listed above have been reviewed, as of the time of this email, in reference to any other eligibility [i.e., SOF/POF] requirements.”

I believe your I-526 is probably in a similar situation.

Best of luck.

I forgot to add: this client’s I-526 was approved within 2 months of our firm’s response to the RFC.

Thank you for sharing this!

Thank you very much for sharing information from practical experience, Charlie.

Charlie, I wanted to ask your advice.

Do you think it’s worth it to try to contact USCIS about it and ask them if they need anything like what you described? Or it’s better to wait for their contact and not try to contact them?

Thank you very much.

Vlad, I believe the best thing to do is reach out to your filing attorney on that matter.

Thank you very much for fast reply and advice.

Vlad, we are probably in the same project, the same group. This is terrible. Most other people get approvals in 20 months or less and we are still waiting… Now we have to worry what happens in September (Eb-5 extension) or about the new visa policy change which will allow to deny almost any application: https://us.cnn.com/2018/07/16/politics/visa-policy-changes/index.html

That’s simply unfair.

Bo, could you please send me you project details to Penpalelina@gmail.com ?

Thank you.

Hi Suzanne,

I am unfortunately one of the investors (with approved I-526 but no conditional GC) whose project was sponsored by the Vermont Regional Center. My project has nothing to do with Jay Peak, and so far has been successful in achieving its goal. The only reason I am now facing rejection from USCIS is because VRC was associated with Jay Peak. Can you suggest what options do I have at this point? My project is requesting USCIS to transfer all its investors to another regional center (which is owned by the parent company). I am not sure whether there is precedence where such a move has been successful?

Under current USCIS policy, a change in regional center sponsor is a material change, and material change between I-526 approval and conditional GC is not allowed. (See the last two sentences in this section of the policy manual: https://www.uscis.gov/policymanual/HTML/PolicyManual-Volume6-PartG-Chapter4.html) However, this policy ought to be revised, for the sake of cases like yours with clearly innocent victims. Even USCIS already realizes this, and proposes to revise it with the EB-5 modernization regulations — see the priority date protection discussion here https://www.federalregister.gov/documents/2017/01/13/2017-00447/eb-5-immigrant-investor-program-modernization. So I’m glad that your project is trying to make the argument, and hope USCIS will listen and set a new precedent. Or that the new regulation will be implemented in time to help you! However, to date I know of no precedent for success, and a couple precedents of failure. For example, https://www.uscis.gov/sites/default/files/err/B7%20-%20Immigrant%20Petition%20by%20Alien%20Entrepreneur,%20Sec.%20203%28b%29%285%29%20of%20the%20INA/Decisions_Issued_in_2014/AUG062014_01B7203.pdf

Thanks for your reply, Suzanne! As always, very thorough. If switching the RC doesn’t work, then what other options do I have left?

Start over by filing a new i-526 is the option suggested in policy. But your project will have gotten better advice than i can give on options and prospects, so consider what they and your lawyer have to say.

Also, is there precedence where USCIS kept issuing conditional GCs/approving I-526s while the RC was appealing the termination?

The only precedents I know of are USCIS denying and revoking petitions while the RC was appealing, since this type of case gets submitted for review. (If cases exist that have a nice result, there’s no appeal so they don’t become public.) To take examples from Path America RC investors:

Click to access JUL192017_01B7203.pdf

Click to access JUL252017_01B7203.pdf

Hi Suzanne,

Is there any statistic report of how many Eb5 investor actually become US citizen?

Of the naturalization data I know, none identify LPR origin by visa category.

Thanks for your reaponse