Updates (Jan 2026 Visa Bulletin, TEA, Regs, Resources)

December 17, 2025 5 Comments

January Visa Bulletin

The January 2026 Visa Bulletin has been published. It has no retrogression and no warnings for set-aside categories, and a huge leap forward for India Unreserved.

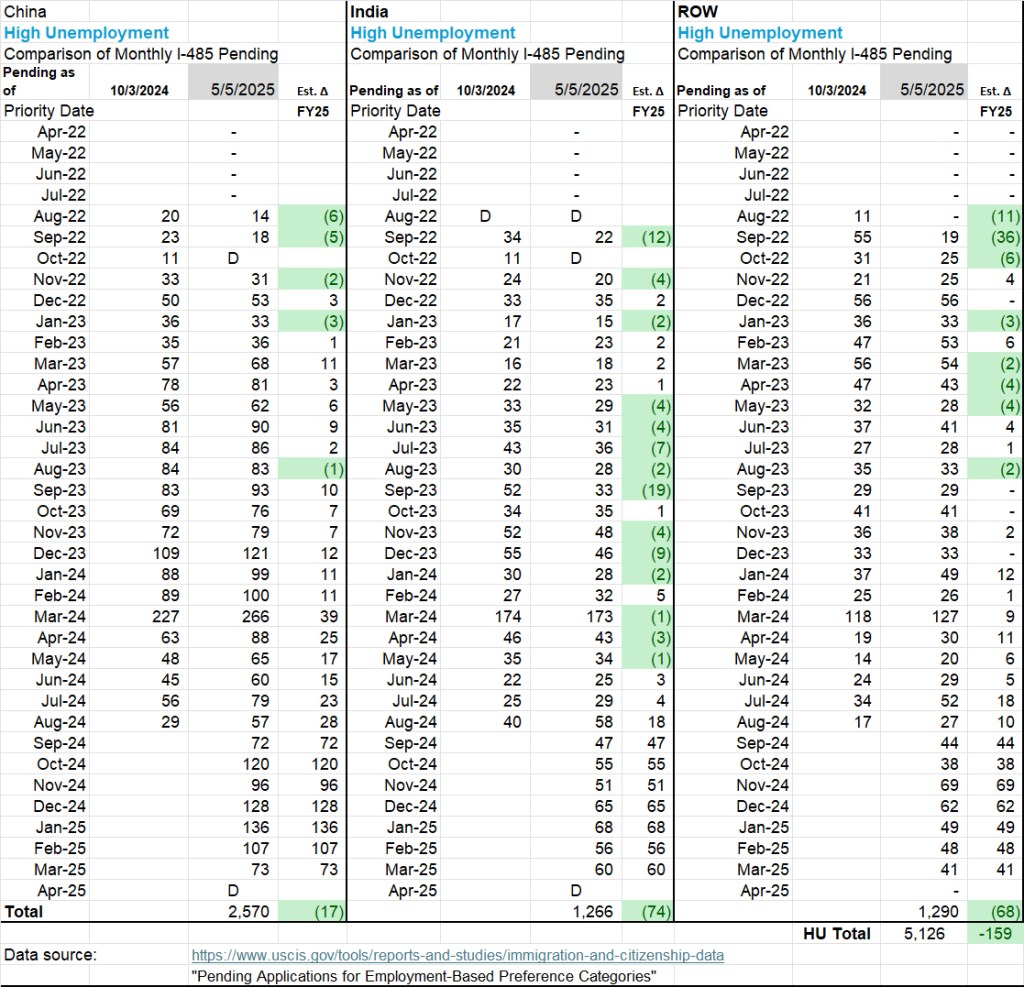

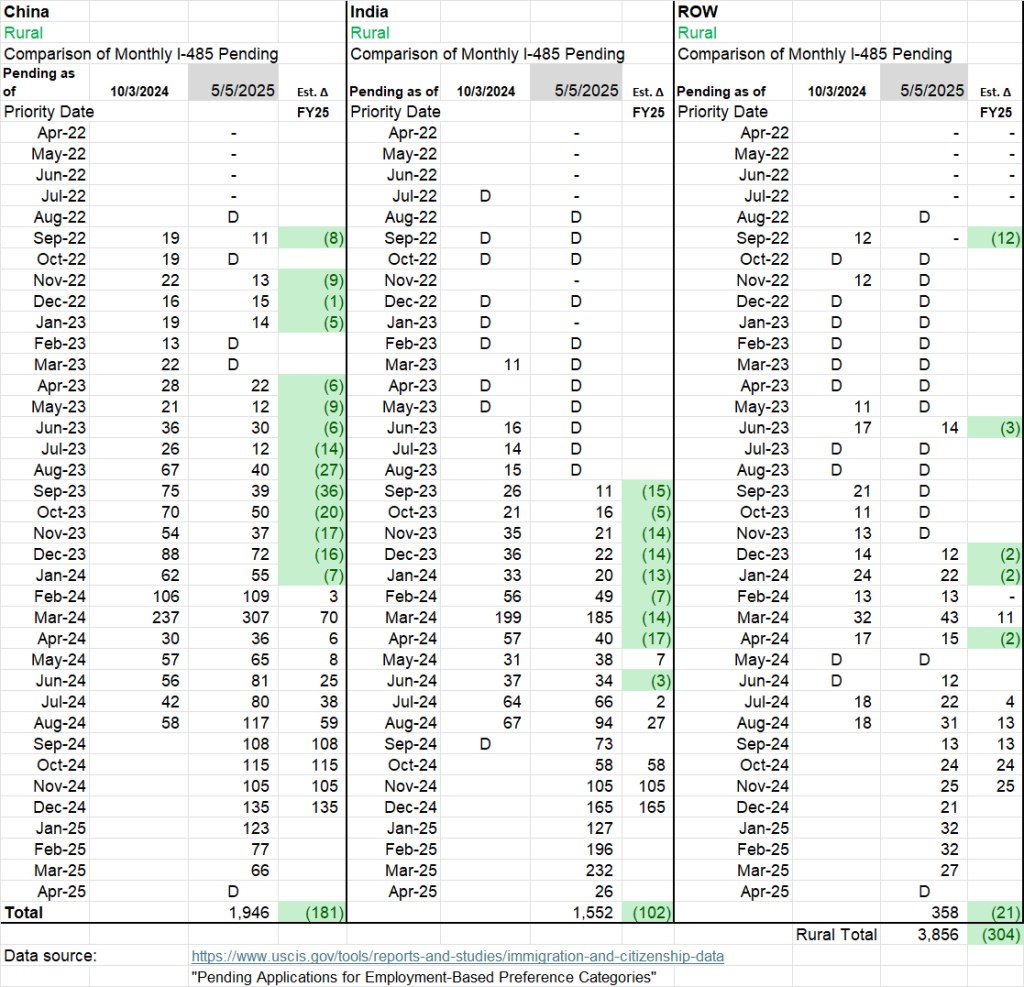

The lack of Visa Bulletin movement for Rural and High Unemployment must reflect lack of movement by the government in processing visa applications. Rural and High unemployment applicants exist, considering the volume of I-526E approvals. As a reminder, last year’s January visa bulletin concluded with a warning that that: “The Department of State and USCIS note increased I-526E petition approvals, and both agencies see increasing numbers of individuals processing their applications to completion in the EB-5 set aside categories” and that therefore “It may become necessary to establish Dates for Filing and Final Action Dates during the fiscal year to ensure that issuances in these categories do not exceed annual limits.” However, FY2025 ultimately had no set aside cutoff dates. And now the January 2026 bulletin includes no renewed warning. The government stopped publishing monthly visa issuance statistics back in May, so there’s no visibility into their progress and performance. But no surprise if visa processing volumes remain low, considering all the new layers of vetting that have been added. So long as we can count on the government for low and slow set-aside visa processing volume, we can count on the Visa Bulletin staying “Current” for set-aside categories (regardless of applicant volume) and on Rural and High Unemployment backlogs continuing to balloon.

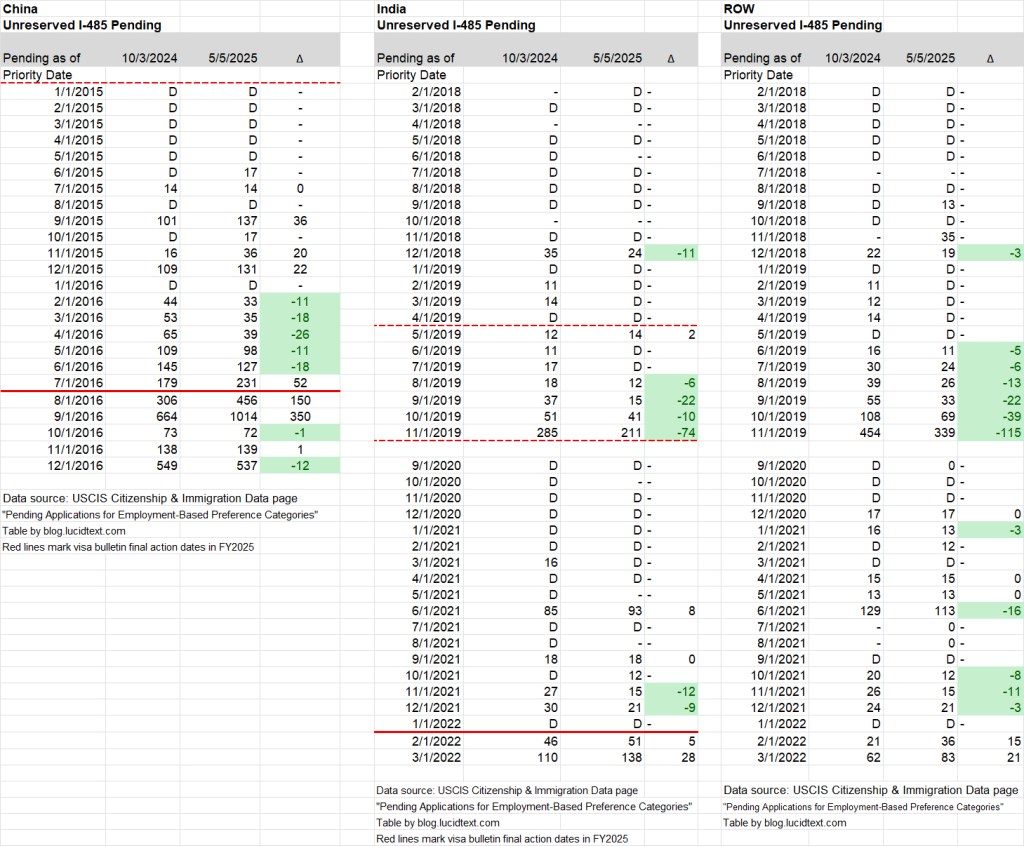

The Visa Bulletin movement for India Unreserved reflects either extremely high India Unreserved visa issuance in recent months, or massive attrition to the number of India-born applicants who appear in data reports to have I-485 pending or be registered at NVC. The January 2026 Visa Bulletin moves India Unreserved dates into post-RIA territory: May 2022 for final action and May 2024 for filing. Could this possibly mean that most pre-RIA India Unreserved applicants already have visas? There were 721 pre-RIA India applicants with pending I-485 alone at the start of FY2026, not to mention however many are waiting abroad, so I doubt. There aren’t even 721 Unreserved visas available to give India this fiscal year, unless the government counts on not issuing visas to Indians in set-aside categories. But the Visa Bulletin movement is extremely interesting. At minimum, it means maximum scope for Indian applicants to get non-FIFO visas, and even for set-aside investors to see opportunity for requesting a visa from the Unreserved category.

TEA Data Change

One of the datasets supporting High Unemployment TEAs traditionally updates annually in December. However, the Census Bureau announced that the 2020-2024 ACS 5-year data release is now deferred to January 29, 2026. This gives another month of validity to current High Unemployment TEA qualifications that depend on ACS data. Once the new data comes up, HUA TEA analyses will need to be updated, and some geographies may gain or lose eligibility based on the new numbers.

EB-5 Regulations

Still no news on the forthcoming new EB-5 regulations to implement RIA, titled EB-5 Reform and Integrity Act of 2022; Ensuring the Integrity of the EB-5 Program (RIN: 1615-AC94). The OMB agenda and litigation had promised publication in November 2025, but apparently this was also delayed by the shutdown.

You still have until December 22 to comment on the U.S. Citizenship and Immigration Services Employment-Based Immigrant Visa, Fifth Preference (EB-5) Fee Rule. Surprisingly few comments have been submitted so far. I plan to add a comment on the proposed Form I-527, and ambiguities around how to implement subsection M to protect investors in terminated regional centers and debarred NCEs.

EAD Change

More entries have been made in the campaign to make immigration more difficult and unattractive, including slashing the EAD validity period. See the IIUSA blog article USCIS Policy Manual Update EAD Validity Period Change Affects EB-5. More countries face limits, and the State Department is expanding its speech surveillance, even requiring children to make their social media profiles public. The government’s mantra is “a U.S. visa is a privilege, not a right.” One day we’ll wake up and realize that attracting the world’s best and brightest to our shores is a privilege, not a right, and that the privilege wants protecting.

EB-5 Resources

AIIA has refreshed its website and made public an amazing resource library originally developed behind a paywall to encourage membership. Check it out! I frequently refer developers to the series of practical informational articles about how to use EB-5, and investors to resources for EB-5 decisions and problem-solving throughout the immigration process, from investment selection to pursuing capital repayment. Use the resources and still consider supporting AIIA with a membership contribution. The EB-5 world needs our associations to be there for us especially now, as the regional center program faces another sunset and battles over policy and program implementation. It’s worth joining forces for a chance to get voices heard and to maximize our shared resources. IIUSA also continues to be an important center for helpful resources and advocacy.

Gold Card

The administration has now published a half-baked application form and launched a website rife with baseless claims in support of the proposed Gold Card program. I blame ignorance/carelessness rather than any malicious or fraudulent intent, but still, such an embarrassment. The basic unseriousness of the program is reflected in the fact that the official pronouncements don’t even agree about when and to which department the notional millions of dollars in gifts would be made (whether to Commerce or Treasury, and whether before or after the USCIS application). Anyone who tries to use this program will get what he deserves – either (A) loss of capital plus ultimately no green card, since the program is not legal and supported by nothing but a President’s word, or (B) loss of capital plus a visa to a lawless country where a one-time president’s word is indefinitely effective in lieu of immigration law. Ideally, the Gold Card will shortly just disappear from consciousness like the whim it is, unused and forgotten. Ideally, before the whiff of scam and scandal has a chance to contaminate and confuse peoples’ understanding of the very different EB-5 program. (If you really want to read more about it, here’s a good article.)