Washington updates, RC termination appeal, SEC (WA), Petition processing

March 21, 2017 Leave a comment

Washington Updates

The comment period for proposed EB-5 regulations closes on April 11, and the regional center program’s current authorization expires on April 28. Either of those immanent deadlines could be associated with significant EB-5 program changes, but I’m not hearing any confident predictions for what will happen exactly. Last week Senators Grassley and Leahy wrote a letter reacting against news that a couple lobbyists for large real estate developers may have recently agreed to “secret backroom deals to thwart reforms.” The senators promised to oppose any such deal, which would presumably protect investment amounts and TEA definitions from significant change, but have yet to reintroduce substantial EB-5 reform legislation of their own. And Congress has so much to do in the next month that one wonders whether our representatives can even agree on a plan to fund the government beyond April 28, much less figure out EB-5 changes. For other commentary on state of play in Washington, see for example posts from IIUSA and Wolfsdorf Law. (This is probably too unserious to even mention, but Representative Steve King of “other people’s babies” fame has introduced another bill, H.R.1502, proposing to repeal the EB-5 program entirely. I don’t see this particular bill going anywhere, not least because terrorist threats may be the one problem EB-5 does not have.)

Appealing Regional Center Termination

Matter of S-D-R-C-, ID# 13768 (AAO Mar. 15, 2017) considers the question of whether or how USCIS would be justified in terminating South Dakota International Business Institute — a regional center that on the one hand has had many successful projects and contributed significantly to economic growth over the years, and on the other hand was – for a number of years, though not currently – in the hands of management charged with various improper activities. The AAO concludes, after interesting discussion deserving industry attention and response: “Evidence of a regional center’s improper or unlawful activities is relevant to the question of whether that center is continuing to promote economic growth, but derogatory evidence must be weighed against countervailing equities on a case-by-case basis. This case contains evidence of the diversion of funds away from job-creating activities, as well as evidence of substantial economic activity that created thousands of jobs. USCIS must consider all relevant factors in determining whether the Applicant’s regional center designation should be terminated or maintained.” AAO withdrew USCIS’s termination decision and remands the matter for further proceedings.

Challenging Capricious Decision-making

Mr. Whalen also posted a decision on the Quartzburg Gold case that I discussed last summer. The court denies part of the plaintiffs’ motion, but grants the plaintiffs’ charge that USCIS was arbitrary and capricious in its decision-making. “First, the reasoning underlying USCIS’s denial of an initial set of Plaintiffs’ petitions was arbitrary and capricious and counter to the evidence before USCIS. Second, USCIS’s decision to treat the petitions of certain Plaintiffs differently than others, despite the fact that all of the Plaintiffs presented effectively equivalent petitions, without providing any explanation for doing so, was also arbitrary and capricious.”

Litigation

The SEC has announced fraud charges against Washington-based businessman Andy Shin Fong Chen and his company Aero Space Port International Group, Inc. The complaint has the usual allegations regarding misappropriation of EB-5 investor funds, and is distinctive in targeting just one of the regional center’s several offerings. The RC response argues that the EB-5 investments are not securities (SEC begs to differ), and points out that the investors involved still support the project and its management (unsurprisingly, considering that they have I-526 petitions pending). I haven’t had time to fill out details in my log of SEC EB-5 cases, but hope someone else will publish an exercise like this to highlight common themes. In an article published today in The Hill, Catherine DeBono Holmes discusses reforms that could help reduce or eliminate the factors that keep repeating in the scattered cases of alleged fraud in EB-5.

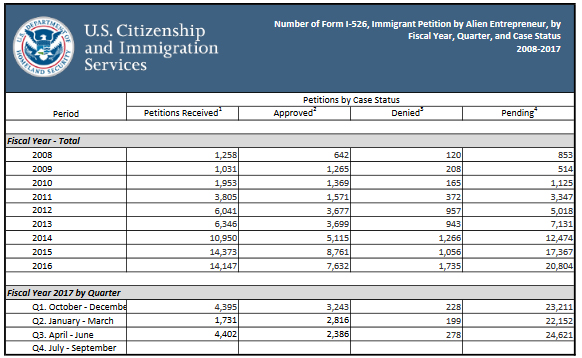

I-526 Petition Processing

The EB-5 Insights blog reports that that IPO seems to be implementing an undeclared policy of holding I-526 petitions in abeyance when an Exemplar I-924 Petition associated with the same new commercial enterprise has been filed. For reference, here is my running log of communications from USCIS regarding EB-5 petition processing practices and times. My EB-5 discussion forum is still open for investors to discuss their experience and progress of the cases they are tracking.