How long does I-924 take?

February 25, 2016 Leave a comment

01/2017 Update: I have newer charts with data through January 2016 here.

–ORIGINAL POST–

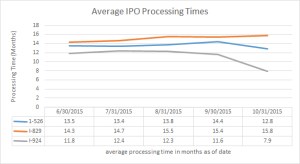

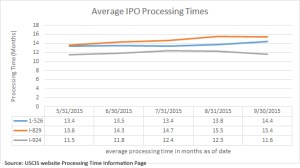

USCIS reports a 8.5-month processing time for the Form I-924 Application for Regional Center as of December 31, 2015 (per the February 2016 IPO processing times report). This number does not distinguish between initial applications and amendment requests, and does not hint at the possible range of actual processing times. It has some base in averaged reality, but we don’t know how it’s calculated.

For more perspective, compare the average times USCIS reported from March 2014 to March 2015 (recorded from past IPO processing time reports) with the times for actual I-924 approvals from the same period (recorded from available regional center designation letters, which show approval date, filing date, and application type).

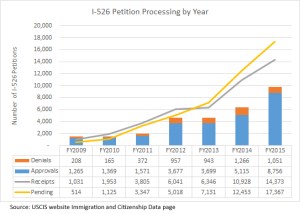

The numbers from designation letters suggest that I-924 amendments in 2014/early 2015 were processed much more quickly and predictably than initial designation requests (although USCIS has said there’s no separate workflow or special treatment for amendments), and that actual processing times have often far exceeded what one would expect from reported averages. The trend from 2014 into 2015 looks somewhat positive. A scatterplot of approvals shows an increasing number of approvals coming in under 10 months (but also that USCIS was still working on applications that had been in the pipeline for 2-3 years). I will be interested to see how the numbers change when I have more letters to add to the data set. USCIS designated 208 new regional centers in FY2015, and there were 902 Form I-924 applications pending at USCIS as of January 2016 (as reported by Mr. Colucci in statements on 2/2 and 2/3). I guess that many of the pipeline I-924s are amendments/Exemplar I-526 filed in mid-2015 ahead of anticipated program changes, not new RC applications, but still 902 is a big number. Regional center applicants filing Form I-924 today should not be too alarmed by the processing time outliers in 2014/2015 (many of those 2-3 year cases were caught up and delayed in the confusion over tenant occupancy, which has been cleared now), but they also shouldn’t count on finishing the process in nine months, considering the backlog and IPO’s past performance.