Visa Numbers Update (Vietnam, India), TEA Reform Proposal, RC Audit Change

October 26, 2017 27 Comments

Visa Numbers Update (Vietnam, India)

We heard some updated EB-5 numbers this week from Charles Oppenheim, the Chief of the Immigrant Visa Control and Reporting within the U.S. Department of State. Bernard Wolfsdorf gives highlights from the presentation in 5 Things I Learned from Charlie Oppenheim at the IIUSA 7th Annual EB-5 Industry Forum. The major news is Mr. Oppenheim’s prediction that Vietnam will have enough demand to be subject to a cut-off date in 2018, and India may need a cut-off date by 2020. Cut-off dates happen when a visa category is oversubscribed and a country demands more than its rightful 7% of available visas in that category. A cut-off date holds back applicants from oversubscribed countries long enough to let any other applicants from undersubscribed countries get first chance at available visa numbers. China is so far over the limit that it’s in an indefinite cut-off date situation with slow forward movement. Vietnam and India are just barely approaching the limit, and don’t have that much competition from other countries, so their cut-off dates would likely be temporary and hardly perceptible unless demand explodes.

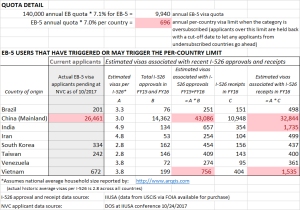

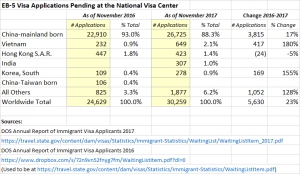

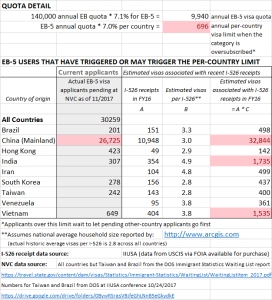

I most appreciated the slide from the Mr. Oppenheim’s IIUSA presentation that gives a breakdown of pending applicants at the National Visa Center by country of origin (for the top five countries) and priority date. I added data from the slide to my Excel file of EB-5 backlog-related info, and correlate it with per-country I-526 receipt data from USCIS. I’m copying below a couple tables that illustrate (1) how we might forecast future cut-off-date-countries from information on I-526 receipts and approvals, and (2) that life is not fair. (Note: see below for updated tables.)

Since the IPO Processing Times report indicates that USCIS has only gotten to processing I-526 filed in November 2015, one wouldn’t expect to see applicants with 2016 and 2017 priority dates already in the visa queue. But Department of State reports nearly 2,000 applicants from the top five countries with priority dates after 2015, which means that USCIS must have processed over 600 petitions out of date order. Of course the number of pending visa applicants with priority dates 2015-2017 is still very small compared with the number of I-526 receipts in those years, so a majority of petitioners are getting held up in slow I-526 processing. I am surprised at the number of applicants with early priority dates still pending at NVC, considering that the China cut-off date progressed to mid-2014 this year (per the Visa Bulletin) and the other countries don’t have a cut-off date.

12/11/2017 UPDATE: The Department of State has provided updated numbers for pending visas in its Annual Report of Immigrant Visa Applicants in the Family-sponsored and Employment-based preferences Registered at the National Visa Center as of November 1, 2017. Here are updated charts based on the new data.

TEA Reform Proposal

Industry discussion about potential legislation has focused on the House-Judiciary Chair EB-5 Reform Proposal, a one-page term sheet with notes for potential future legislation. The term sheet proposes replacing the current Targeted Employment Area (TEA) system with a R/UD system. R/UD stands for Rural or Urban Distressed – two areas that would be incentivized for EB-5 investment with a slightly lower investment amount and fees, reduced job creation requirement, and – most potent of all – set-aside visas.

A couple major questions to consider: which projects would qualify for incentives under the R/UD proposal, and who’d be the winners and losers, were the term sheet to become legislation and then law?

- The term sheet briefly defines Urban Distressed criteria: “must meet 2 out of 3 of the New Market Tax Credit Criteria.” The NMTC program has several sets of criteria, but we’ll assume the staffers mean the NMTC criteria for “severe distress” (since that’s the criteria referenced in previous EB-5 draft legislation): Poverty rate greater than 30 percent; median family income not exceeding 60 percent of statewide median; unemployment rates at least 1.5 times the national average. The term sheet gives this cryptic description of Rural criteria: “Base law + census tracts that would qualify under base law except for the fact that they are located in the outlying counties of MSA’s with population densities of less than 400 psm + Hatch fix.” I believe that means: Rural is an area with a population under 20,000 that is outside a Metropolitan Statistical Area (or a low population/low density area within the outskirts of an MSA). With those definitions in mind, you can get a sense of whether a project location might qualify for R/UD incentives using the CDFI Fund Mapping page provided by the US Department of the Treasury. For urban projects, select the NMTC mapping tool. When you enter the project address, the NMTC tool will bring up a map of census tracts around that address, with relevant NMTC data for poverty rate, income, and unemployment for each census tract. Check these numbers against the NMTC Severe Distress threshold, recalling that the EB-5 proposal would require 2 of 3 criteria to qualify. For rural projects, choose the BEA tool on the CDFI Fund Mapping page. This will bring up a map that lets you search by address and discover whether the address is in a non-metropolitan area, and the local area population. (To be sure of R/UD qualification, you’d need some additional guidance: whether and to what extent it’s allowable to group and average data across more and less distressed urban census tracts, what it means to be “outlying” in the rural context, and what source and date of data would be accepted. The term sheet doesn’t specify this.)

- To judge winners and losers, we look at proposed incentives for R/UD investment. The term sheet suggests that investments in R/UD areas would be incentivized in these ways: 1,500 annual set-aside visas each for R and UD (with any unused visas rolling over from year to year in the same category), $925,000 minimum investment, reduced job creation requirement (5 indirect), option for exemplar somewhat-premium processing (one year), and exemption from an extra visa fee. Investments outside R/UD areas would have a $1,025,000 minimum investment, compete for the 6,940 annual visas remaining after set-asides, and would be subject to a visa fee of $50,000. The R/UD definitions and visa set-asides would become available on the date of enactment, affecting everyone with a visa pending at that time. The term sheet specifies that people with pending petitions and applications wouldn’t need to increase their investment amount, but they would find themselves in a line suddenly made about 40% longer by set-asides that reduce the generally available visa pool. The term sheet offers this limited relief: “For 1 year after DOE, any unused set-aside visas may be used by investors who had filed petitions pending as of DOE that meet the new definitions of R/UD.” However, I guess that few pending petitions fall in that category. This means that the #1 loser in this proposal is the past investor still waiting on conditional permanent residence. Congressional staffers don’t cry over the past investor, because they’re annoyed by the filing surges that happened in recent years (while they failed to act) and have wanted retroactivity. Self-interested RC lobbyists may also have few tears for past investors, whose money is in the bank and whose presence in the backlog represents the major drag on recruitment of new investors. A small negotiating table could see a win-win in a proposal that could discourage past applicants into clearing out the backlog and smooth the way for new rural/urban distressed investment (effectively incentivized with set-asides) and new prosperous urban investment (still competitive thanks to minor investment amount difference). Industry players who care about past investors and clients exist, and I hope their concern will signify.

Audit and Inspection Change

The page on the USCIS website that formerly explained Regional Center Compliance “Audits” and Site “Inspections” now describes Regional Center Compliance “Review” and Site “Assessments.” It’s interesting that USCIS revised the titles to sound less threatening, though the promised content of the audit/review or inspection/assessment remains almost unchanged. The one content change I notice on the page is an additional bullet point for Regional Center Compliance Review: “Assess the effectiveness of internal controls related to the regional center’s administration, oversight, and management functions.”

Hi Suzanne, Thank you for the update from the conference. Do you know if there are numbers available for “EB-5 Applicants Pending at the National Visa Center as of October 12, 2017” for India? I thought India was one of the top 5 nations but I dont see India in your table (that is 2.c)

I will ask Bernard Wolfsdorf if he can get those numbers from Charlie Oppenheim. For whatever reason, India wasn’t on the NVC slide in the presentation for IIUSA.

Thank you so much Suzanne. I will wait to see your comment with India numbers in this thread/post.

I couldn’t get this data earlier, but now know from the DOS waiting line report that 307 EB-5 visa applications for Indian nationals were pending at NVC as of November 2017. https://travel.state.gov/content/dam/visas/Statistics/Immigrant-Statistics/WaitingList/WaitingListItem_2017.pdf

Thank you for the update. With a 9/30/2016 EB-5 India priority date, in your opinion, what is the realistic time frame for I-526 approval? Fairly disappointed that backlog keeps increasing with each month. Thank you.

In theory, I-526 is first-in-first-out by date, regardless of country or other factors. So being from India should not help or hurt your time for I-526. Because IPO promised to prioritize processing times in 2018, and receipt volumes have fallen since 9/2016, I guess that you’ll see less than the current 21-month timeframe.

Thanks again Suzanne for the excellent write-up and prediction calculations.

Do we know why the petition count for FY2017 is so low compared to FY2016? Only 126 + 2 + 0 + 14 + 6 = 148 applicants from those counties in the entire year?

I see that my chart is not clear enough. The 148 figure refers to current visa applications for people whose I-526 petitions were filed in 2017; it is not I-526 petitions filed in 2017. So 148 is not surprisingly low but surprisingly high, since one wouldn’t expect a petition filed in 2017 to already have been approved and progressed to the visa application stage. The bottom half of my chart doesn’t show 2017 receipts since they weren’t included on the IIUSA data report, but this post gives aggregate petition receipt numbers for 2017: https://blog.lucidtext.com/2017/09/21/q3-2017-eb-5-petition-processing-data/

Thanks Suzanne. As always you’ve summarized the situation eloquently.

Hi Suzanne, thanks for the update, which many of us were waiting to hear from you. 40% longer queue for I-526 will definitely hurt all pending applications (and as a consequence, I guess all future applications as well?).

Any feedback on the likely effective date for the new enactment? There were some discussions previously of 1 year grace period for the new quotas to be effective.

The term sheet says “Phase In: 4 month moratorium after DOE on the filing of I- 526s and I-924s.” and, for non R/UD investments: “In months 5-12 after DOE, up to 7,000 investors and their derivative spouses and children can be approved for visas at an investment level of $925,000.” But I’m just looking at one page of sketchy notes, not legislation. I understand that this page represents an offer from Senator Grassley’s office, not a final deal. I don’t know how long it could take for a bill to be written up and get a chance for inclusion in passable legislation, but trust that the public would get a chance to preview and react to the actual bill text.

Hello Suzanne thanks for the information. I am still trying to understand the sheet in order to have a prediction on how long it is going to take to have the i-526 approved for applicants from non-chinese (actually Brazilian) on April-17. Any guess? thank you.

I-526 processing, in principle, is a first-in-first-out process regardless of nationality. The simplest prediction calculates processing time based on data about pending petitions and IPO’s rate of adjudication. Here’s my attempt to calculate: https://www.dropbox.com/s/5rxaen68enfwlda/I-526time.xlsx?dl=0

I was wondering if there was any news on i829 processing at the dial in today? Thanks

Yes, a lot of processing news. I’ll put up a post as soon as possible.

Suzanne, Is it still possible to apply for Viet Nam? I have a client requesting information.

Is processing longer or shorter for Viet Nam? Thank you.

It is still possible to apply for Vietnam. There is currently no country-specific difference in I-526 processing time — the I-526 process is basically first-in-first-out regardless of nationality. Since a Vietnam cut-off date is predicted for next year, the client might experience a delay at the visa application stage, but probably not a long one.

Thanks for this comment, I was about to ask the same question.

Here is my post with processing updates: https://blog.lucidtext.com/2017/11/11/11-7-and-11-10-ipo-updates-processing-bridge-financing-more-baruch-college-conference-rc-list-updates/

I also keep a log of IPO comments on petition processing here: https://www.dropbox.com/s/9nhw2axfbkk6t20/IPO%20Times%20Quotes.docx?dl=0

Wonderful, thank you. There is so little information about I829 processing times.

I829 processing times seem to be getting longer and longer. I’m assuming that as times goes on, and if nothing changes wait times will get longer. Theoreticaly speaking lets say for whatever reason a person with a condition green card has not had his/her i829 approves due to long wait times for 3 years after their conditional green card was supposed to expire, can that person be grandted citizenship? This person would technically have lived in the US on a valid green card for more than 5 years. I assuming this person kept getting 6 month extensions.

Yes, I have a similar opinion. This is an interesting problem. I think that the law about citizenship does not know anything about temporary green cards… But probably they will find a reason why citizenship cannot be granted. Does anyone know more about it?

Here is one opinion from an article that’s partly outdated, since written in 2011, but I believe this part is still current:

What happens if the adjudication of the I-829 is delayed and the investor meets the residence requirements necessary to apply for the naturalization? Although there is a good argument under the statute and regulation that the investor is eligible to be naturalized,[32] the USCIS position is that the investor is eligible to apply for naturalization but cannot be approved until the condition removal is approved.[33] There is no circuit court opinion on this issue as of the date of publication of this article.

Article: http://www.klaskolaw.com/article/removal-of-eb-5-conditions-to-avoid-removal-of-the-investor/

Footnotes:

[32] The INA explicitly states that conditional permanent residents have the same rights and benefits as any other lawful permanent resident. 8 USC § 1186b(e). The plain language of this provision requires USCIS to count periods of time in conditional permanent resident status as satisfying the statutorily mandated five year residency time period for purposes of determining eligibility for naturalization. See 8 U.S.C. § 1427(a)(1). The regulations also state that “the rights, privileges, responsibilities and duties which apply to all other lawful permanent residents apply equally to conditional permanent residents, including but not limited to the right to apply for naturalization (if otherwise eligible).” 53 Fed. Reg. 30011, 30018 (final rule) (Aug. 10, 1988) (codified at 8 CFR §216.1); see also 59 Fed. Reg. 26587, 26590 (final rule) (May 23, 1994).

[33] Memorandum, Neufeld, Scialabba, Chang, “Conditional Permanent Residents and Naturalization under Section 319(b) of the Act, Revisions to Adjudicator’s Field Manual Chapter 25, AFM Update AD 09-28 (August 4, 2009). AILA InfoNet Doc. 09080761.

Suzzane, Thanks for your good report, very complete.

I have my receipt I-526 application on dec 9, 2015. I just note in IPO processing time page, that on September 30 they are processing files from dec 18, 2015. This means that my file is now under review, but, what can I expect about the approval date? I mean, once the file is being under review, how long time will take to deliver an answer?

I’ll appreciate your opinion.

You should expect to hear within 30 days. See the email copied in this post: https://blog.lucidtext.com/2017/02/13/understanding-uscis-processing-time-reports/

Hi Suzanne,

Got lots of answers. Thanks.If I apply from India for eb 5 visa this month. What kind of time frame should I expect for approval? Thanks.