FY2019 EB-5 Visa Stats by Country

February 21, 2020 27 Comments

The Report of the Visa Office 2019 has been published, with EB-5 visa statistics in Table VI Part IV (visas issued through consular processing) and Table V Part 3 (consular processing plus I-485 status adjustment). The statistics reflect number of green cards issued for conditional permanent residence by country of origin.

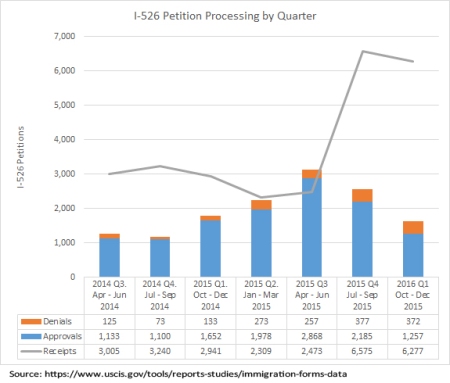

In a sense this is old news – not only because Charles Oppenheim summarized this data at the IIUSA conference last October, but also because EB-5 visas issued in FY2019 reflect EB-5 investment decisions made at least two years ago (for most countries, considering I-526 processing times) or five years ago (for China, considering the visa bulletin). To understand current EB-5 demand, we need per-country I-526 data from the beginning of the process. But USCIS resists disclosing such I-526 data, so we make do with visa statistics that reflect usage midway through the EB-5 process.

A few questions that occur to me, as I look at visa statistics:

- How close did Department of State get to its goal of issuing the total visas available for the year under numerical limits?

- How are EB-5 applicants divided between people living abroad and people already in the US? What populations in the United States are using EB-5 to adjust status?

- Beyond the few top countries, how is the EB-5 market diversifying or concentrating?

- How many EB-5 visas are actually going to investors, and how many to spouses and children?

- Which data points deserve a film contract?

The EB-5 numerical limit is not a fixed number, but 7.1% of a total number of EB visas that varies each year, further divided by the 7% per-country cap. The EB numerical limit for FY19 was 141,918 visas, which put the EB-5 share for FY19 at 10,076 visas, and the individual country share at 705 visas. In practice, it’s not possible to hit the targets exactly. In FY2019, DOS unluckily undershot the worldwide target (issuing only 9,478 total EB-5 visas) but slightly overshot the per-country target for India and Vietnam (which each ended up with more than 705 visas). The worldwide visa numbers don’t reflect lack of demand (there were plenty of visa applications left pending at the end of the year), but complications in the process (p. 2-3 of this article explains some reasons).

US entrepreneurs promoting EB-5 investments may wonder: should I buy plane tickets, or can I find potential EB-5 investors in my own back yard? Visa statistics for consular processing vs adjustment of status can help answer this question. The data shows, for example, that nearly half of South Americans who received EB-5 visas in FY19 were not living in the South America, but already residing in the US on different visas. Likewise 31% of the EB-5 visas to Europeans, and 34% of those to Indians, went through status adjustment in the U.S. By contrast, 90% of EB-5 visas issued to China-born people in FY19 went through consular processing. (But China being China, even the 10% from status adjustment in the U.S. is still a large number: 433 people). Africans got a record (for Africa) 334 visas in FY2019, most of them issued abroad.

The Report of the Visa Office does not itemize visas by principals and derivatives, but the DHS Yearbook of Immigration Statistics does. I’ve added a pie chart below with the most recent data (2018) as a reminder that the 10,000 or so annual EB-5 visas do not – as Congress intended – support 10,000 investments in the US economy, or 100,000 jobs. Because Department of State believes that it needs to fit whole families into the numerical limit, the EB-5 quota is only able to incentivize around 3,300 investments annually. In FY2018, just 3,363 EB-5 visas went to principals i.e. EB-5 investors. The majority of EB-5 visas (42%) went to children. (Interestingly, nearly a third of EB-5 applicants in FY18 apparently immigrated without spouses.)

Back to the Report of the Visa Office, FY2019 was similar to FY2018 in terms of country diversification, with similar regional distribution and number of countries contributing to the visa total. Growing diversification was more evident between FY17 and FY18. The number of visas leftover for Chinese dropped significantly between FY17 (about 7,500) and FY18 (about 4,500), but remained about the same in FY19 (about 4,300). (That could change in FY21, if the visa availability approach succeeds in pushing a larger volume of rest-of-world applicants out of I-526 to the visa stage.)

I would like to see the film about the high-net-worth Chadians and North Koreans who managed to connect with EB-5 projects, document source of funds, and secure EB-5 visas in FY2019. And all those ones promise poignant stories – I’m curious about that one Croat, the one Kazahk, the one Surinamese, and the lone Kiwi who immigrated through EB-5 in FY19.

A few charts to highlight features of interest to me.

And finally, a reminder that visas can only be issued to people with active visa applications. The March 2020 visa bulletin ends with a reminder to Chinese with I-526 approval to get documentarily qualified at NVC, or risk losing place in line. The China Final Action date just jumped five months — not due to lack of Chinese with approved I-526, but due to lack of Chinese eligible to be called for a visa interview.

E. EMPLOYMENT-BASED FIFTH PREFERENCE VISA AVAILABILTY (note from March 2020 visa bulletin)

There has been a very rapid advancement of the China-mainland born fifth preference final action date for the month of March. This action has been taken in an effort to generate an increased level of demand. Despite the large amount of registered China fifth preference demand, currently there are not enough applicants who are actively pursuing final action on their case to fully utilize the amount of numbers which are expected to be available under the annual limit.

Once large numbers of applicants do begin to have their cases brought to final action, some type of corrective action may be required to control number use within the annual limit. It is important to remember that applicants who are entitled to immigrant status become documentarily qualified, and potentially eligible for interview, at their own initiative and convenience. By no means has every applicant with a priority date earlier than a prevailing final action date been processed for final visa action.

This brochure from DOS gives an overview of the NVC process and what it means to be documentarily qualified.